The business press is much more sensitive to signs of price increases than it is to signs of price decreases.

So it’s good to see The Wall Street Journal take note of the fact that some critical commodities have been plunging in recent weeks.

The months-long rally in commodity prices has sparked fears it could ignite inflation or cripple consumer spending. But a surprising trend is now sweeping the markets for some key materials: Prices are falling.

Goods from cotton to zinc that were highfliers late last year have turned into laggards in recent weeks. Several have logged double-digit-percentage declines in futures markets.

Cotton has pulled back 17% from the all-time record set in early March, and sugar is down 34% from its multidecade high in February. Lead and zinc have tumbled in recent weeks after shooting up in the second half of 2010. Copper has shed 6% this year.

This hardly means that the commodities boom is over. But the point is that commodities aren’t necessarily reliable predictors of overall prices.

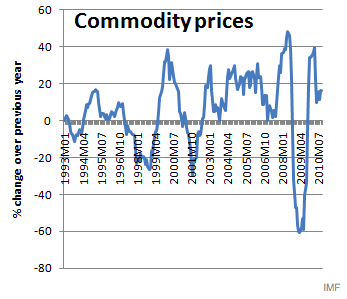

First, they’re extremely volatile. Here’s a chart Paul Krugman pulled a few months ago from the IMF on commodities price swings over a seventeen-year period:

Commodities are also susceptible to speculation and manipulation, as well as currency fluctuations. A good part of the soaring price of oil is the declining dollar, which makes imports more expensive while making our exports cheaper.

Also, they’re usually a small part of the final cost of a product. And we sure haven’t seen any signs of significant wage increases lately. As David Leonhardt says:

It’s all but impossible to have an inflationary spiral if wages are not rising rapidly. Companies may want to increase prices because their energy costs are rising, but if customers don’t have the buying power to pay higher prices, most price increases won’t stick.

The Journal puts it this way:

Still, if declines in other commodities persist, they could provide ammunition to Federal Reserve Board governors and others who argue the commodity rally is a passing phenomenon and won’t spark inflation so long as unemployment stays high and wage growth is weak.

My question on Leonhardt’s assertion is that even though American wages are stagnant, it doesn’t mean wages in, say, China are. As they and other developing countries increase their wealth, they increase their ability to claim resources, putting upward pressure on commodity prices from outside the U.S. Will that be significant enough to decrease the standard of living here over the long term? Has it already?

Ryan Chittum is a former Wall Street Journal reporter, and deputy editor of The Audit, CJR’s business section. If you see notable business journalism, give him a heads-up at rc2538@columbia.edu. Follow him on Twitter at @ryanchittum.