This post is the first of several primers on Social Security we will publish in the coming weeks to help journalists report on this topic.

The Washington Post, whose news columns and opinion pieces have beat the drum for entitlement reform and cutting the federal deficit, banged out an editorial Sunday making a case for changing the way the cost-of-living formula for Social Security benefits is calculated. The editorial is significant because the Post’s reporting has led in shaping media coverage of Social Security. When the Post talks, the Beltway cognoscenti listen, and changing the COLA formula—which allows Social Security benefits to keep pace with inflation—is front and center in the grand bargain discussions.

Why is the alternative, called the chained Consumer Price Index, so attractive? It cuts spending and raises revenue, the twin strategies for reducing the federal deficit. The Congressional Budget Office estimates that the chained CPI could produce some $217 billion in savings. Roughly $145 billion would come from monthly benefit cuts to Social Security recipients and others who receive government pensions or veterans benefits. The COLA formula would also be applied to the tax code and affect tax brackets and refundable deductions such as the Earned Income Tax Credit, bringing in another $72 billion or so. But about half the total savings, or some $112 billion, comes from cuts to Social Security, which the Social Security Administration estimates could solve about one quarter of the program’s projected shortfall. This makes the formula a juicy target for changes the media have rushed to promote.

The Post editorial gave its rationale for cutting the COLA formula and substituting the chained CPI, which some economists have been trumpeting as a more accurate measure of inflation for increasing monthly benefits, cloaking its argument in benign language. “The pain it inflicts on beneficiaries and taxpayers would be minimal, widely shared and phased in gradually. And all it would require is a quick administrative tweak,” the Post argued. The paper has said this before in its news columns. And its factchecker, Glenn Kessler, recently addressed the issue of what the chained CPI is all about.

Last year when there was another spurt of Beltway interest in the chained CPI, the Post reported changing the formula would take only a “technical adjustment” and that “experts have long argued that the formula overstates inflation because it does not take into account changes in consumer behavior in response to rising prices.” In other words, under the current formula when the price of steak goes up, seniors will eat less or buy hamburger. The proposed index takes into account other responses to rising prices like eating out less or eating more at home. But it doesn’t work well when it comes to substituting health services, a growing expense for the elderly. If you need a heart by-pass, you can’t substitute a hernia operation.

Other publications have bought into this argument. As if to build support for the measure, Bloomberg News in a 2011 report piled on quotes from four members of Congress and experts all extolling the virtues of the chained CPI and essentially making the same point. “I don’t see how anybody can argue against having accurate formulas,” said Idaho Sen. Mike Crapo, a Republican. Marc Goldwein, former associate director of the administration’s deficit commission, threw in his two cents: “We’re measuring inflation wrong now and it’s obvious we should measure it right.” Mark Zandi, the chief economist at Moody’s Analytics, noted there is a “pretty widely held” consensus among economists that the old formula exaggerates inflation. Bloomberg readers could hardly have missed the message: the old formula had to go.

But wait, there’s more to the story than choosing hamburger instead of steak. It’s called how seniors actually live and make choices in the real world, something too often forgotten in the land of policy wonks and the Washington press. They may not substitute eat-at-home as the string of economists suggest. Social Security expert Alicia Munnell, also an economist who runs the Center for Retirement Research Center at Boston College (and whom I interviewed here), told the New York Times, which last year reported one of the better stories on the topic: “If you are down to paying your rent and your food, and the price of your food goes up, you probably just eat less.” Munnell could have added they pay for their medicine before buying groceries.

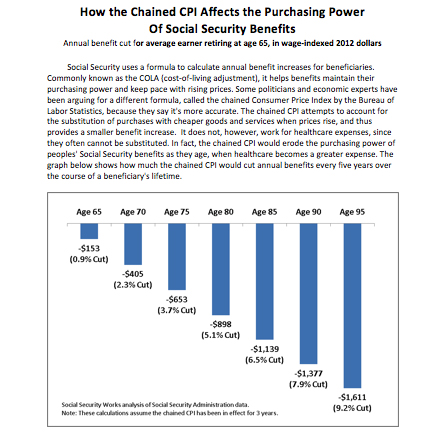

The chained CPI increases benefits 0.3 percent less than the current formula, and the slower increase in benefits compounds every year, meaning that as someone gets older, the effect is greater as the below chart shows (click on it to enlarge). A person age 75 will get a yearly benefit that is $653 lower than someone would get under current arrangements, while someone age 85 will have $1,139 less to live on. That pinches.

|

As the nonpartisan, nonprofit National Academy of Social Insurance noted in one of its fact sheets:

Because Social Security provides an ever-greater share of elders’ incomes as they grow older—as pensions are eroded by inflation, employment options end, and savings are depleted—even a minor erosion of the real value of benefits is a public policy concern.

So far, the press has given this public policy concern the brush off. The task for jounos is not so much explaining the intricacies of the chained CPI or the current consumer price index, or to pass along the notion that the change is simply a technical tweak, but to broaden the debate perhaps with some of the 300 economists and social scientists who recently issued a statement opposing the chained CPI or those who work with older adults and learn how real people, especially the oldest of the old, actually spend their money. In a New York Times op-ed last summer, New School economist and pension expert Teresa Ghilarducci wrote “the specter of downward mobility in retirement is a looming reality for both middle- and higher-income workers.”

The elephant in the room, of course, is health care and the increasing costs seniors will bear in the form of higher cost sharing which will be required soon under the most popular Medigap plans. They will also face higher Part B premiums especially if more seniors must pay the higher income-related premium, a provision likely to be in the deficit reduction mix. An annual cut of $653 for 75-year-olds may not sound like much to wealthy bankers, but it might help seniors pay higher Part B premiums or their increased out-of-pocket medical costs.

The Post editorial gave a quick nod to the problem of rising medical costs, but argued the “immediate impact [of the changes] is negligible” and future retirees have time to adjust. It noted that a “modest lump sum” could be given to people “well into their 80s” to help them out with increasing expenses. The Simpson-Bowles deficit commission report called for beneficiaries to receive a small increase after they’ve been getting Social Security checks for 20 years. How helpful is this especially for older women whose income may only be around $1100 a month, the average benefit for all social security beneficiaries? “Aging is the gateway to poverty,” Ghilarducci says. This is a good place for the media to begin connecting the dots among proposed changes to Social Security that lower benefits and the proposed changes to Medicare that raise expenses for health care. How will seniors manage?

Related stories:

Dart: CBS and the Goldman Sachs solution

What a higher Retirement Age really means

Medicare, Paul Ryan, and beyond: a primer

Trudy Lieberman is a longtime contributing editor to the Columbia Journalism Review. She is the lead writer for CJR's Covering the Health Care Fight. She also blogs for Health News Review and the Center for Health Journalism. Follow her on Twitter @Trudy_Lieberman.