On Monday, Politico published a powerful investigation of so-called “social welfare” groups that mislead the Internal Revenue Service about their political activities in applying to gain tax-exempt status. In 2012 alone, Politico identified more than $134 million in political spending by organizations that pledged that they would not engage in politics on their applications to the IRS to be recognized as nonprofits.

The story follows a fruitful line of inquiry that CJR urged reporters to dig into last week. Our October 12 story, “How to Expose Dishonest ‘Social Welfare’ Groups,” offered a step-by-step formula for reporters for how to find out whether a group running political ads in their area had misrepresented its activities to the IRS.

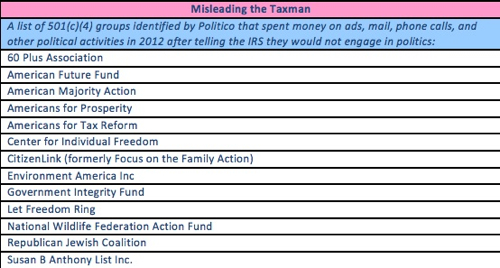

The Politico investigation reveals just how pervasive advertising by dishonest social welfare groups has become. Their story identifies at least thirteen 501(c)(4) organizations—as they are known in reference to the section of the tax code that governs their activities—that have spent money this year on political ads, mailers, phone calls and other activities after telling the IRS they would not seek to influence elections. Politico’s Kenneth Vogel has shared the names of these groups with CJR, which we have listed in the chart below.

Politico’s investigation also raised the question of whether revealing this type of misrepresentation would have any impact on the groups that engage in it. The story noted that the IRS had not revoked or proposed to revoke the tax-exempt status of any 501(c)(4) groups from March to September, and noted that many of these groups argue that their hard-hitting “issue ads” that criticize candidates without explicitly calling for their defeat do not constitute political activity. In one passage, Vogel and co-author Tarini Parti even suggested that the IRS had accepted this claim:

AFP has turned in its tax returns every year, just as the law requires, reporting that it did not spend a dime on politics—an answer that seems implausible from a common-sense perspective, but one that the IRS appears to have accepted as consistent with its vague and ambiguous definition of political activity.

On this point, Politico may have gone too far. The IRS has not issued formal rules or statements indicating that they have accepted issue ads or other specific election-related activities by social welfare groups to fall outside the sphere of political activity. In fact, they don’t appear to have any clear policy at all. As ProPublica’s Kim Barker wrote in her exhaustive investigation of social welfare groups in August, “the [Federal Election Commission] has specific guidelines for what constitutes a political ad, while the IRS goes case by case, looking at the content of ads, when they ran, and how they relate to groups’ other spending.”

The distinction between the IRS having unclear rules and weak enforcement in regard to 501(c)(4) groups’ activities on the one hand, or accepting these groups’ claims that their election-related activities are not political on the other, may seem to be splitting hairs. But this difference has major implications for the future. As Vogel of Politico noted, the IRS often takes years to act against groups that it finds to have violated tax law. When it does, it can crack down hard: in 2007 the IRS fined the liberal political action committee America Coming Together $775,000 for misuse of unregulated political contributions during the 2004 presidential campaign.

In response to our question about this point, Vogel wrote that the IRS had declined to answer questions about specific social welfare groups. He also pointed to us a letter the IRS sent to Senator Carl Levin about its policy on nonprofits—in which the agency said that it had adopted the position that 501(c)(4) groups could engage in some political activity as long as they “primarily engaged in activities that promote social welfare.”

CJR asked the IRS yesterday about their policy on social welfare groups, and we have yet to receive a response. We will follow up as soon as we hear back—and hope that reporters will continue to keep the pressure on to clarify the rules for social welfare groups that misreport their activities to the IRS.

Sasha Chavkin is an investigative reporter specializing in the environment, Latin America, and public corruption. He was the lead reporter for OCCRP's "Nicaragua's Forgotten Deforestation Crisis" investigation, and is currently a 2021-22 Ted Scripps Fellow in Environmental Journalism at the University of Colorado at Boulder.