A Credit to the Los Angeles Times for excellent reporting that shows conventional wisdom—that a significant number of homeowners are choosing to default on their home loans—to be an urban myth

Bankers and housing market analysts are warning of a chilling new trend in the mortgage world: Homeowners voluntarily defaulting on their loans even though they can actually afford to make the payments.

It’s known colloquially as ‘walking away,’ or more jocularly as ‘jingle mail,’ from the sound your house keys supposedly make when you mail them back to your bank.

The rumor isn’t just echoing around the money chambers, but across the media as well. The catch? No proof:

But there’s a major problem with all this talk about the phenomenon of solvent homeowners ‘walking away’: There doesn’t appear to be any hard evidence that it’s actually happening.

When pressed for the number of borrowers who could afford their mortgage payments, major banks and lender groups could not produce numbers figures.

Who would start such a meme?

Bruce Marks, CEO of Neighborhood Assistance Corp., a Boston-based nonprofit agency that helps strapped homeowners, says flat out that the notion that legions of borrowers are simply deciding not to pay is an ‘urban myth’ that largely reflects the mortgage industry’s desire to blame homeowners, rather than their lenders, for the surge in problem loans.

Marks and others assert that mortgage bankers have an incentive to blame the rise in delinquencies and foreclosures on borrowers skipping out on obligations they’re financially able to meet, because that diverts attention from the lenders’ own role in the mortgage crisis.

This is sharp reporting by the LAT, which refused to let stand an industry-fueled rumor.

The New York Times also took on the “jingle mail” myth, in an article the same day, but the piece did not go so far as to take the lending industry to task. It does have a damning hard number, though. Freddie Mac, the mortgage firm, says 0.14 percent of its mortgages in default were abandoned.

Both papers report that to the extent it can be proved there’s any “jingle mail” at all, it’s due to speculators, who don’t live in the house to begin with.

The man. The dream. The baloney.

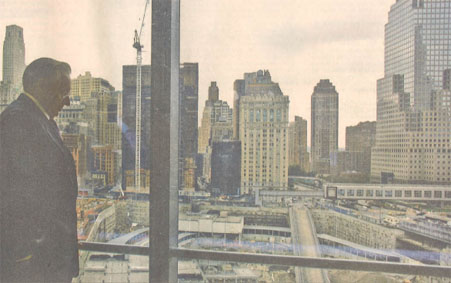

A Debit to The New York Times for a cringe-worthy piece, the likes of which we had hoped never to see again: a fluff profile of ground zero developer Larry Silverstein.

Really, NYT, you’re making our job at Debits & Credits too easy.

We’ve said our piece on Silverstein: on how he got the best of the ground zero negotiations despite the fact that he was a major hindrance to progress, and how the press fell for the gutsy underdog spin. So we won’t repeat the details.

We’ll just give a few choice lines from Wednesday’s Times article. First, the headline: “The Optimistic (and Long) View of Larry A. Silverstein.”

Now, if we didn’t do this for a living, we would have stopped right there. But, for your sake, Dear Reader, we forged on. The lede:

Larry A. Silverstein, the New York developer, is used to being second-guessed.

And later:

The energetic Mr. Silverstein has other reasons to smile these days. At a time when many developers around the country are being forced to pull in their reins because of the credit squeeze, Mr. Silverstein has only to look out his floor-to-ceiling windows to see a new real estate empire in the making.

And:

…Mr. Silverstein is a famously tough negotiator. But he is also known for his unusually optimistic personality.

Last fall, a fawning profile in the FT set us on a two-day examination of World Trade Center redevelopment coverage (which in turn led to a spirited exchange with our friends at Esquire). Despite a few bright spots, we found the press had largely abdicated its responsibility to hold Silverstein accountable for his central role in the rebuilding mess.

Again, we find ourselves amazed at Silverstein’s PR acumen.

As we stared disconsolately at the Times piece, we couldn’t help but notice how similar the lead photo is to the FT’s last year. In both, we see Silverstein in his 7 World Trade Center, overlooking the ground zero site.

Here’s the old FT photo

Here’s the new Times one.

Notice that the site itself looks pretty much as it did last fall, as it did the fall before, and so on. Which is to say, it looks like a big construction pit nearly seven years after 9/11. There is a difference, however: Silverstein is now smiling broadly into the camera.

He has reason to.

Glasnost on WSJ’s edit page

A Credit to The Wall Street Journal’s op-ed pages for opening up to an alternative point of view: Thomas Frank’s. And it’s a weekly column, not a one-time thing.

Frank this week discusses the widening income gap between rich and poor and the decline of the middle class, and gets about as far from Journal orthodoxy as you can in laying blame.

It has not merely ‘happened’; it has been done to us. The distinction is an important one to keep in mind as we survey the ruins of the affluent society. What has overtaken America’s working people is not a natural disaster like ‘globalization,’ and not even some kind of societal atavism in which countries regress mysteriously to their 19th-century selves. This is a man-made catastrophe, a result that proceeded directly from the deliberate beatdown of organized labor and the wrecking of the liberal state.

It is, in other words, a political disaster, with tax cuts, trade agreements, deregulatory measures, and enforcement decisions all finely crafted to benefit one part of society and leave the rest behind.

These are strong words. Stronger still because they appear is on the op-ed pages of the Journal, which has been liberal-free since it sidelined Al Hunt, who’s now at Bloomberg.

As the Times now publishes the right-wing William Kristol, who just a couple of years earlier called for it to be prosecuted for treason, it seems right that the Journal publishes the left-wing Frank, even if the column leaves some readers sputtering.

WSJ on the quake: magnificent and heartbreaking

A Credit to The Wall Street Journal for its heartbreaking front-page piece on a mother’s search for her son, buried in the rubble of last week’s earthquake in southwestern China (part of an overall package of superb work by the paper all week).

The piece, by Gordon Fairclough, starts:

For two days after Monday’s earthquake demolished her house and those around it, Deng Yizhen and her family tried to claw through the rubble and rescue her only child, 34-year-old Deng Yujian.

They tried to flag down rescue crews and cranes. None stopped to lend a hand, they said.

All were rushing elsewhere to grapple with the disaster.For the first few hours, Mr. Deng called for help. He spoke from under a deep pile of

broken concrete slabs to his mother and his wife, Qin Ke. ‘I told him I would get him

out,’ says Ms. Qin, whose legs were gashed as she dug in the debris. ‘But he said he was

too badly hurt. He said he wouldn’t make it. He told me not to wait for him.’

We’ll leave the rest for you to read. It speaks for itself. Congrats to the WSJ generally for its stellar coverage of this disaster.

Insight into Scruggs’s fall

A Credit to The New Yorker for an intriguing story (abstract) on how prominent tobacco- and insurance-industry crusader Dickie Scruggs got involved in a bribery scandal that brought down his law firm.

The question that drives the piece:

The reaction to the indictment was incredulity. Scruggs had achieved rare standing among trial lawyers—as a visionary, whose extravagant fee awards allowed him to discount, with some credibility, money as his prime motivation. He was said to have scored a billion-dollar fee in the tobacco case. Why would he bother with a tawdry little bribery scam?

Reporter Peter J. Boyer takes us inside the world of Mississippi politics:

Mississippi lawyers keep score, counting each other’s divorces and courtroom outcomes. Scruggs is not the only one of them to have been portrayed in the movies (‘The Insider’), or to pilot his own jet, but he is the only lawyer notable for both distinctions.

The story never quite answers the question of why Scruggs got involved in that “tawdry little bribery scam.” But it’s a story as old as the classics: money and power corrupt— even those whose very mission is to tackle money, power, and corruption.

Who knows? Not him

A Debit to MarketWatch for a video (embedded in this column) that’s almost a parody of a news report.

The video accompanies a column by Jon Friedman on how, having hired Norman Pearlstine, “the Bloomberg company is making a statement: It’s poised to do something BIG.”

Something big?

That primes us to not expect too many details. But the video falls short of even that low expectation.

Friedman intones:

Bloomberg LP, Mike Bloomberg’s company, is doing something big.”

Yep. Got that.

He then goes on to explain (we’re trying to be nice):

I’m not sure what. Nobody’s sure what….Something’s going on there for sure.

Got that?

And finally…

A Credit to Next American City for a cover story on sustainable development in areas prone to fire, floods, and other natural disasters.

We like this piece for its broad take on the issue of development in vulnerable areas. Flood and fire are not quite opposites: both require adaptive building techniques and a respect for the instability of the natural environment.

This piece is especially useful during a week when the National Research Council criticized the Army Corps of Engineers’ plan for coastal Louisiana, and we heard the disturbing news that the structural integrity of thousands of levees across the country is unknown to the Corps, which oversees them.

Elinore Longobardi is a Fellow and staff writer of The Audit, the business-press section of Columbia Journalism Review.