The Times got a nice scoop today, reporting that the white-shoe private-equity firm Carlyle Group is under investigation by New York Attorney General Cuomo for its role in a scandal at the state’s pension fund.

Last month, grand jury indicted two aides to the ex-state comptroller on 123 counts related to them allegedly taking tens of millions of dollars in kickbacks from investment firms for giving them state business. Carlyle was one of those firms that gave them placement fees.

The inquiry, which is examining the activities of a number of investment companies, focuses on what has been a widespread practice among hedge funds and private equity firms — paying so-called placement agents to gain business managing the pension funds run by states for public employees. Such payments often raise questions about conflicts of interest and concerns that they lead placement agents to bribe public officials.

The Times gives us some good analysis, detecting a pattern showing Carlyle has been in dicey situations for paying to get access to pension money in the past:

Carlyle’s efforts to gain pension business in other states have drawn criticism before, but company officials have never been charged with any wrongdoing.

I thought the story was going to leave it at that, but the Times proved me wrong, coming back to this bit of history at the bottom of the story:

In Connecticut, Carlyle gained entrée to the state pension in the late 1990’s by hiring Wayne L. Berman, an influential Washington lobbyist, who then worked for the consulting firm Park Strategies.

At a 2003 corruption trial, Paul J. Silvester, the former Connecticut state treasurer, testified that Mr. Berman discussed a lucrative job for him at Park Strategies at the same time Mr. Berman was seeking business on behalf of Carlyle. The pension fund invested tens of millions of dollars with Carlyle, and soon after the deal Mr. Silvester left state service to take the job at Park. He later spent four years in jail after pleading guilty to federal charges that included racketeering and conspiracy.

The Times notes that the SEC, which also filed civil charges against the former state employees last month, signaled then that there were more shoes to drop and that it thinks it has the goods:

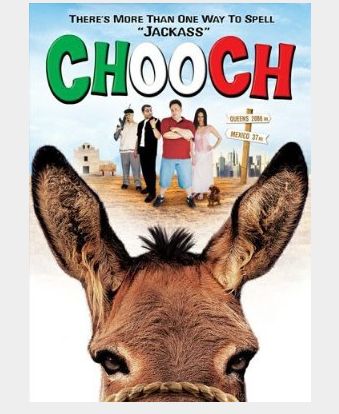

The March indictment accused Mr. Morris and Mr. Loglisci of pressuring the investment firms to do business through Searle,, which in turn paid Mr. Morris millions of dollars. It also alleged that Mr. Morris helped Mr. Loglisci by securing him a promotion within the comptroller’s office and by investing $100,000 in a low-budget movie Mr. Loglisci produced with his brothers called “Chooch.” Mr. Hevesi, who resigned in late 2006 after pleading guilty to an unrelated felony, has not been charged in the case.

In its complaint, the S.E.C. said at least some investment firms — which the agency did not name — were well aware of what the agency called “a fraudulent scheme to extract kickbacks” and made “sham” payments “pursuant to undisclosed quid pro quo arrangements.”

Anybody seen Chooch? Thumbs up or thumbs down?

Hey, don’t just a film by its cover!

I’d love to see Manohla Dargis take a whack at this one.

But good for the Times news staff for sticking with this story. It’s one to watch.

Ryan Chittum is a former Wall Street Journal reporter, and deputy editor of The Audit, CJR’s business section. If you see notable business journalism, give him a heads-up at rc2538@columbia.edu. Follow him on Twitter at @ryanchittum.