The Rortybomb blog has an illuminating post on how the mortgage industry used credit scores to replace old-fashioned due diligence—and how it didn’t work.

It points to an academic paper that found that securitization, unsurprisingly, backfired. Apparently, there was a credit-score cutoff of 620 for what mortgages could be included in securitized debt like collateralized-debt obligations.

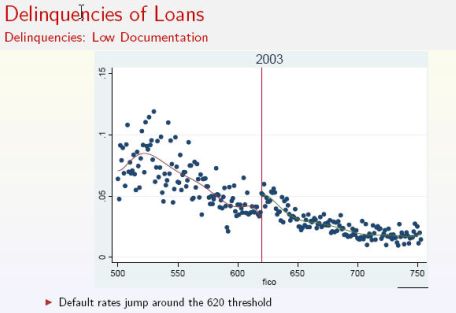

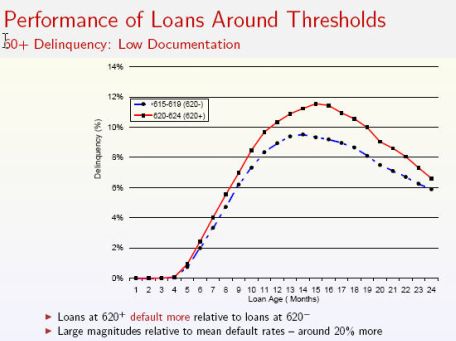

The research found that delinquency rates were noticeably higher for borrowers with FICO scores a few points above the cutoff compared to borrowers just below 620. Check out the good chart—you can see clearly a huge break in the trendline right at 620.

Rortybomb says this is because of the rise in the reliance on computers and the de-emphasis of human judgment, or “soft skills”:

…the part of the mortgage application that isn’t just a function of your FICO score and a few quantifiable variables. The soft-skills part has almost entirely been replaced by quantification over the past decade.

I’d also note that the below-620 mortgages were thus not part of the Wall Street machinery, which incentivized banks and brokers to churn out as many loans as possible, quality be damned. I’d also point out that it seems logical that this trend, which showed 20 percent more delinquencies for the higher-rated mortgages, doesn’t just apply to the 615 to 625 credit range. We can assume it applies all the way up the chain. In other words, prime mortgages 720 credit scores by the Wall Street sausage machine with will be significantly more likely to go bad than those that aren’t securitized.

It’s another credit on the side of old-fashioned banking.

This should cast some doubts on how much large banks can provide social utility by replacing the soft skills, the comparable advantage of small and mid-sized banks, with number-crunching computers, Ivy-Leaguers and giant bonuses.

Or as Ryan Avent of Portfolio says, via Rortybomb:

A lot of recent financial innovation has been defended on grounds that it improved the flow of credit or made credit easier to obtain. But increasingly it seems that it did this by allowing everyone to stop doing their homework. Magical de-risking processes made the need to do homework before investing unnecessary. Magical hedging formulas did the same thing, and saved lenders the trouble of caring when a borrower got in trouble. The financial system became like a fancy new car — full of top-of-the-line safety features, traction control, ABS, and so on. And like drivers who seem so effortlessly in control and completely safe that they forget how deadly two tons of steel traveling at 80 miles per hour can be, market participants were lulled into forgetting how dangerous finance can be.

Right. Good stuff.

(h/t FT Alphaville)

UPDATE: Reader Chris Corliss makes an excellent point in comments—that the research specifically pointed to low-documentation loans (ie, NINJA or stated-income loans) as having the discrepancy around the FICO score of 620. The researchers found no similar weirdness in full-documentation loans, ones where borrowers have to document their income and the like.

Also, to clarify, the 620 cutoff for securitization was not hard and fast. It was a rule of thumb that meant it was somewhat less likely.

The discrepancy between the results for low-doc and full-doc loans still shows the perils of securitization. Lenders who knew they were going to unload loans immediately had much less incentive to turn the screws on borrowers and more incentive to shovel them into loans that banks didn’t know they could pay off.

After all, the banks and brokers were making big fees creating the loans, then selling them off to investors who would take the hit on any losses.

Ryan Chittum is a former Wall Street Journal reporter, and deputy editor of The Audit, CJR’s business section. If you see notable business journalism, give him a heads-up at rc2538@columbia.edu. Follow him on Twitter at @ryanchittum.