On Tuesday the Center for Responsible Lending dropped an interesting study that highlighted the role of mortgage brokers in the subprime debacle. The CRL study of 1.7 million loans between 2004 and 2006 found that mortgage brokers steered weaker borrowers into costlier loans that generated more revenue for the brokers, while offering cheaper loans to stronger customers, who by definition would have more options. The brokers, of course, were responding to incentives. They relied on volume for prime borrowers, while relying on higher-cost subprime loans as profit centers.

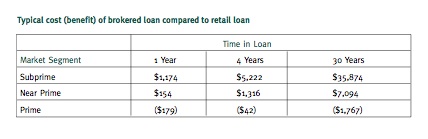

Overall, CRL found that subprime borrowers paid more than a $1,000 a year extra for brokered loans than they did for the same subprime loans from lenders.

Here’s a chart from the study:

Of course, subprime loans are more complicated, and weaker borrowers will pay higher rates. The problem here is that brokers were incentivized to push already marginal borrowers into loans that would ultimately send them over the edge.

Big Media mostly passed on the study, though the Boston Globe posted a blog entry on it. A Chicago Sun Times News Group website ran an edited press release.

CBS picked up an item on it that the Washington Monthly posted on its Political Animal Blog.

The blog Calculated Risk posted the most in-depth article on the study of any of the above.

Passing on a nonprofit’s study is certainly a defensible editorial call for overstretched news organizations. On the other hand, as we’ve said, CRL was warning about subprime years before the business press was jarred awake to the dangers last summer.

Anna Bahney is a Fellow and staff writer for The Audit