Den of thieves It was no secret that institutionalized corruption had taken wing on Wall Street. (Christopher Anderson via Magnum Photos)

This is an excerpt from The Watchdog That Didn’t Bark: The Financial Crisis and the Disappearance of Investigative Journalism, published this month by Columbia University Press. It has been edited for space and to conform to CJR editorial style.

“I have made no criticism in this book which is not the shoptalk of reporters and editors. But only rarely do newspapermen take the public into their confidence. They will have to sooner or later. It is not enough for them to struggle against great odds, as many of them are doing, wearing out their souls to do a particular assignment well. The philosophy of the work itself needs to be discussed; the news about the news needs to be told.”

–Walter Lippmann, Liberty and the News, 1920

The US business press failed to investigate and hold accountable Wall Street banks and major mortgage lenders in the years leading up to the financial crisis of 2008. That’s why the crisis came as such a shock to the public and to the press itself. ¶ And that’s the news about the news.

The watchdog didn’t bark. What happened? How could an entire journalism subculture, understood to be sophisticated and plugged in, miss the central story occurring on its beat? And why was it that some journalists, mostly outside the mainstream, were able to produce work that in fact did reflect the radical changes overtaking the financial system while the vast majority in the mainstream did not?

This book is about journalism watchdogs and what happens when they don’t bark. What happens is the public is left in the dark about, and powerless against, complex problems that overtake important national institutions. Few need reminders, even today, of the costs of the crisis: 10 million Americans uprooted by foreclosure with even more still threatened, 23 million unemployed or underemployed, whole communities set back a generation, shocking bailouts for the perpetrators, political polarization here and instability abroad. And so on and so forth.

Was the brewing crisis really such a secret? Was it all so complex as to be beyond the capacity of conventional journalism and, through it, the public, to understand? Was it all so hidden? In fact, the answer to all those questions is “no.” The problem–distorted incentives corrupting the financial industry–was plain, but not to Wall Street executives, traders, rating agencies, analysts, quants, or other financial insiders. It was plain to the outsiders: state regulators, plaintiffs’ lawyers, community groups, defrauded mortgage borrowers, and, mostly, to former employees of financial institutions, the whistleblowers, who were, in fact, blowing the whistle. A few reporters actually talked to them, understood the metastasizing problem, and wrote about it. Unfortunately, they didn’t work for the mainstream business press.

In the aftermath of the Lehman bankruptcy of September 2008, a great fight broke out over the causes of the crisis–a fight that’s more or less resolved at this point. While of course it’s complicated, Wall Street and the mortgage lenders stand front and center in the dock. Meanwhile, a smaller fight broke out over the business press’ role. After all, its central beat–the one over which it claims particular mastery–is the same one that suddenly melted down, to the shock of one and all. For business reporters, the crisis was more than a surprise. There was even something uncanny about it. A generation of professionals had, in effect, grown up with this set of Wall Street firms and had put them on the covers of Fortune and Forbes, the front page of The Wall Street Journal and The New York Times, and the rest, scores of times. The firms were so familiar, the press had even given them anthropomorphized personalities over the years: Morgan Stanley, the white-shoe wasp firm; Merrill Lynch, the scrappy Irish-Catholic firm, often considered the dumb one; Goldman, the elite Jewish firm; Lehman, the scrappy Jewish firm; Bear Stearns, the naughty one, etc. Love them or hate them, there they were, blessed by accounting firms, rating agencies, and regulators, gleaming towers of power. Until one day, they weren’t.

Critics contended, understandably, that the business press must have been asleep at the wheel. In a March 2009 interview that would go viral, the comedian Jon Stewart confronted the CNBC personality Jim Cramer with the problem. Stewart said, in effect, that business journalism presents itself as providing wall-to-wall, 24/7 coverage of Wall Street but had somehow managed to miss the most important thing ever to happen on that beat–the Big One. “It is a game that you know is going on, but you go on television as a financial network and pretend it isn’t happening,” is how Stewart framed it. And many understood exactly what he meant.

Top business-news professionals–also understandably, perhaps–have defended their industry’s pre-crisis performance. In speeches and interviews, these professionals assert that the press in fact did provide clear warnings and presented examples of pre-crisis stories that told about brewing problems in the lending system before the crash. Some have gone further and asserted that it was the public itself that had failed–failed to respond to the timely information the press had been providing all along. “Anybody who’s been paying attention has seen business journalists waving the red flag for several years,” wrote Chris Roush, in an article entitled “Unheeded Warnings,” which articulated the professionals’ view at length. Diana Henriques, a respected New York Times business and investigative reporter, defended her profession in a speech in November 2008: “The government, the financial industry and the American consumer–if they had only paid attention–would have gotten ample warning about this crisis from us, years in advance, when there was still time to evacuate and seek shelter from this storm.” There were many such pronouncements. Then the press moved on.

It is only fair to point out that, beyond speeches and assertions, the business press has not published a major story on its own peculiar role in the financial system before the crisis. It has, meanwhile, investigated and taken to task virtually every other possible agent in the crisis: Wall Street banks, mortgage lenders, the Federal Reserve, the Securities and Exchange Commission, Fannie Mae, Freddy Mac, the Office of Thrift Supervision, the Office of the Comptroller of the Currency, compensation consultants, and so on. This kind of forensic work is entirely appropriate. But what about the watchdog?

In the spring of 2009, the Columbia Journalism Review, where I work as an editor, undertook a project with a simple goal: to assess whether the business press, as it contended, did indeed provide the public with adequate warning of looming dangers when it could have made a difference. The idea was to perform a fair reading of the record of institutional business reporting before the crash. We created a commonsense list of nine major business news outlets (The Wall Street Journal, Fortune, Forbes, Businessweek, the Financial Times, Bloomberg, The New York Times, the Los Angeles Times, and The Washington Post) and used news databases to search for stories that could plausibly be considered warnings about the heart of the problem: abusive mortgage lenders and their funders on Wall Street. We then asked the news outlets to volunteer their best work during this period, and, to their credit, nearly all of them cooperated.

The result was “Power Problem,” published in the spring of 2009. Its conclusion was simple: The business press had done everything but take on the institutions that brought down the financial system. The record shows that the press published its hardest-hitting investigations of lenders and Wall Street between 2000 and 2003, even if there were only a few of them. Then, for reasons I will attempt to explain, it lapsed into useful but not sufficient consumer- and investor-oriented stories during the critical years of 2004 through 2006. Missing are investigative stories that directly confront powerful institutions about basic business practices while those institutions were still powerful. The watchdog didn’t bark.

To read various journalistic accounts of mortgage lending and Wall Street during the bubble is to come away with radically differing representations of the soundness of the US financial system. It all depended on what you were reading. Anyone “paying attention” to the conventional business press could be forgiven for thinking that things were, in the end, basically normal. Yes, there was a housing bubble. Any fair reading of the press of the era makes that clear, even if warnings were mitigated by just-as-loud celebrations of the boom. And yes, the press said there were a lot of terrible mortgage products out there. Those are important consumer and investor issues. But that’s all they are. When the gaze turned to financial institutions, the message was entirely different: all clear. It’s not just the puff pieces (“Washington Mutual Is Using a Creative Retail Approach to Turn the Banking World Upside Down“; “Citi’s chief hasn’t just stepped out of Sandy Weill’s shadow–he’s stepped out of his own as he strives to make himself into a leader with vision“; etc.) or the language that sometimes lapses into toadying (“Some of its old-world gentility remains: Goldman agreed to talk for this story only reluctantly, wary of looking like a braggart”; “His 6-foot-4 linebacker-esque frame is economically packed into a club chair in his palatial yet understated office”). It’s that even stories that were ostensibly critical of individual Wall Street firms and mortgage lenders described them in terms of their competition with one another: Would their earnings be okay? There was a bubble all right, and the business press was in it.

Trouble was, the system it was covering was going to hell in a hand basket. Institutionalized corruption, fueled by perverse compensation incentives, had taken wing. The subpriming of American finance–the spread of a once-marginal, notorious industry to the heart of the financial system–was well underway. If this had been a big secret, that would be one thing, but if that were true, how was it that Forbes, of all magazines, could write a scathing exposé of Household Finance, then a subprime giant, under the headline “Home Wrecker” in 2002, but not follow it up with a similar piece until it was too late? How could The Wall Street Journal publish stories like the brilliant “Best Interests: How Big Lenders Sell a Pricier Refinancing to Poor Homeowners . . .” around the same time, on its prestigious front page, then nothing of the sort later, when the situation got much, much worse? Meanwhile, still in 2003, a reporter named Michael Hudson was writing this:

A seven-month investigation by Southern Exposure has uncovered a pattern of predatory practices within Citi’s subprime units. Southern Exposure interviewed more than 150 people–borrowers, attorneys, activists, current and ex- employees–and reviewed thousands of pages of loan contracts, lawsuits, testimony, and company reports. The people and the documents provide strong evidence that Citi’s subprime operations are reaping billions in ill-gotten gains by targeting the consumers who can least afford it.

Who is Michael Hudson? And what on earth is Southern Exposure? For that matter, why was an urban affairs reporter for an alternative weekly in Pittsburgh, with no financial reporting experience, able to write this (emphasis added):

By its very nature, the mortgage-backed securities market encourages lenders to make as many loans at as high an interest rate as possible. That may seem a prescription for frenzied and irresponsible lending. But federal regulation, strict guidelines by Fannie Mae and Freddie Mac, intense and straightforward competition between banks, and the relative sophistication of bank borrowers have kept things from getting out hand, according to the HUD/Treasury reporter. Those brakes don’t apply as well in the subprime lending market, where regulation is looser, marketing more freewheeling and customers less savvy.

The date? 2004. One type of journalism told one kind of story; another presented an entirely different reality. What accounts for these dramatically opposed representations? And why was the conventional business press perfectly capable of performing both kinds of journalism when the problems were small but incapable of providing the valuable, powerful kind later, when it counted?

Walter Lippmann is as right today as he was in 1920. It’s not enough for reporters and editors to struggle against great odds as many of them have been doing. It’s time to take the public into our confidence. The news about the news needs to be told. It needs to be told because, in the run-up to the global financial crisis, the professional press let the public down.

It needs to be told because the mortgage crisis and its aftermath have coincided with a crisis in the news business. Google and a new vanguard of internet companies have wreaked havoc on traditional news-media business models, siphoning away a huge chunk of the advertising revenue that had long sustained American journalism. Once-great newsrooms have been devastated and thousands of former print reporters are out on the street or in PR. Their former colleagues now operate in a harrowing and harried new environment of financial distress and sped-up productivity requirements. Meanwhile, a new digital journalism ecosystem has bloomed with new publications, models, forms, practices, idioms, tools, and institutions.

Another fierce argument is underway about the future of news–about who will do it, what it will look like, and who–or what–is this “public” that journalism is supposed to be speaking to. As in all times of crisis, the consultants, marketers, and opportunists of various stripes–never far from journalism–step forward to proclaim that they know what the future holds. But no one really knows. The only thing we can be sure of in journalism is that everything is in question, everything on the table: business models, forms, roles, practices, values. Will news organizations survive? Can amateur networks help? Is storytelling out of date? Is statistical analysis–known as Big Data–the next breakthrough? That the new digital era has not lived up to its promise is no reason to dismiss it.

So we stand at a moment when established journalism can be fairly said to have failed in a basic function, and, as usual, the future is uncertain. And the present, well, it’s a bit of a mess. Is there no hope?

Actually, there is. One form of journalism has proven itself an effective advocate for the public interest, a true watchdog, and proven itself at least since the great Ida Tarbell in the early 20th century. It’s neither alternative nor mainstream. It’s not necessarily professional or amateur. It’s neither inherently analogue nor digital. It’s a practice.

The practice has never really had a good name. Sometimes it’s called “accountability reporting.” Sometimes it’s called “investigative reporting.” Sometimes it’s called “public-service reporting” or “public-interest reporting.” Sometimes it’s called something else. We’ll go with “accountability reporting.” Accountability reporting is a journalism term of art–the shoptalk of reporters and editors, as Lippmann would put it. But it’s one the public would do well to better understand.

Accountability reporting sounds like something everyone would be for, but that’s actually not the case. It only arrived as a mainstream, professionalized practice in the 1960s and has had to fight for its existence within news organizations ever since. Confrontational and accusatory, it provokes the enmity of the rich and powerful as a matter of course. When Theodore Roosevelt dubbed it “muckraking” in 1906, he didn’t mean it as a compliment. Risky, stressful, expensive, and difficult, it perennially faces resistance within news organizations and tries the patience of bureaucrats, bean counters, and hacks. News corporatists, such as the late USA Today founder Al Neuharth and mogul Rupert Murdoch, deride public-service reporting–or anything that resembles it–as a form of elitism, an affectation of prize-mongering and self-important reporters, journalists writing for “other journalists,” as one Murdoch biographer puts it. Withholding resources for public-interest reporting, as we’ll see, is invariably couched as opposition to “long” and “pretentious” stories foisted on the public by “elitist” reporters. But opposing long and ambitious stories is like fully supporting apple pie but opposing flour, butter, sugar, and pie tins. In the end, there is no pie.

In our digital age, impatience with accountability reporting is, if anything, more pronounced. The economics and technological architecture of online news militate against accountability reporting. As a result, digital-news advocates, too, tend to ignore it or dismiss it altogether. “The whole notion of ‘long-form’ journalism is writer-centered, not public- centered,” as Jeff Jarvis, a prominent digital-news thinker, tweeted. Yet accountability reporting is a core function of American journalism. It is what makes it distinctive, what makes it powerful when it is independent. It is the great agenda setter, public-trust builder, and value creator. It is the practice that explains complex problems to a mass audience and holds the powerful to account. It is the point.

Now is a good time to consider what journalism the public needs. What actually works? Who are journalism’s true forefathers and foremothers? Is there a line of authority in journalism’s collective past that can help us navigate its future? What creates value, both in a material sense and in terms of what is good and valuable in American journalism?

Accountability reporting comes in many forms–a series of revelations in a newspaper or online, a book, a TV magazine segment–but its most common manifestation has been the long-form newspaper or magazine story, the focus of this book. Call it the Great Story. The form was pioneered by the muckrakers’ quasi-literary work in the early 20th century, with Tarbell’s exposé on the Standard Oil monopoly in McClure‘s magazine a brilliant example. As we’ll see, the Great Story has demonstrated its subversive power countless times and has exposed and clarified complex problems for mass audiences across a nearly limitless range of subjects: graft in American cities, modern slave labor in the US, the human costs of leveraged buyouts, police brutality and corruption, the secret recipients on Wall Street of government bailouts, the crimes and cover-ups of media and political elites, and on and on, year in and year out. The greatest of muckraking editors, Samuel S. McClure, would say to his staff, over and over, almost as a mantra, “The story is the thing!” And he was right.

“Access reporting,” the practice of obtaining inside information from powerful people and institutions, is the longstanding rival of accountability reporting. They are American journalism’s two main tendencies, and the tension between the two can be said to define the field. The access and accountability schools represent radically different understandings of what journalism is and whom it should serve. The two practices produce entirely different representations of reality, and this difference proved critical in the run-up to the crash. Access reporting emphasizes gaining inside information from the actions or intentions of powerful actors before they are widely known. Its stock-in-trade is the scoop, or exclusive. In business news, the prototypical access story is the mergers-and-acquisitions scoop. Accountability reporting, in contrast, seeks to gather information not from but about powerful actors. The typical accountability story is the long-form exposé.

I usually keep in mind proxies for the two schools: Gretchen Morgenson, the great investigative reporter and editor for The New York Times, and Andrew Ross Sorkin, who runs Dealbook, a thriving unit of the same paper that focuses on inside scoops about business mergers and acquisitions. Morgenson was the first to reveal–in the face of furious opposition from Goldman Sachs, among others–the beneficiaries of the bailout of the American International Group, namely Goldman Sachs and other Wall Street banks. Sorkin’s monumental crisis book, Too Big to Fail, lionized Wall Street figures for their (failed) efforts to avert a catastrophe their own institutions had caused. That the two leading representatives of the two journalism poles work for the same newspaper only emphasizes the degree to which journalism must balance both tendencies.

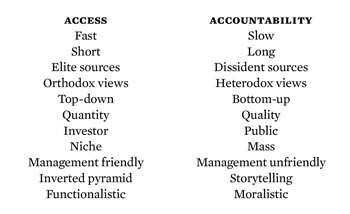

One way to think about the difference is that access reporting tells readers what powerful actors say while accountability reporting tells readers what they do. Access reporting tends to talk to elites; accountability, to dissidents. Access writes about specialized topics for a niche audience. Accountability writes about general topics for a mass audience. The differences are so stark that they can be distilled into a list:

Access tends to transmit orthodox views; accountability tends to transmit heterodox views. In business news, access reporting focuses on investor interests; accountability, on the public interest.

Access and accountability, then, are journalism’s Jacob and Esau, Gog and Magog, forever in conflict over resources, status, and influence. But it’s hardly a fair fight. Access reporting is journalism’s bread and butter. Its stories are quicker to produce and rarely confrontational, making them more compatible with news-productivity needs. Accountability reporting, meanwhile, is forever marginal, a cost center, burdened with stories that are time consuming and enemy making. But of the two strains, only one speaks to, and for, the broader public.

I come to this debate from a 30-year career as a journalist, 10 of those as an investigative reporter, 10 as a business reporter. I’ve done both access and accountability reporting and understand the necessity of both. The problem for journalism and the public, however, is that accountability reporting is at once the most vital and, at the same time, the most vulnerable. The difference between the two is the difference between probing Citigroup in 2003 and profiling it in 2006. Put simply, accountability reporting got the story that access reporting missed.

This book will trace the development of the watchdog from its roots in muckraking and its struggle to win a place in the mainstream media. In a sense, I hope to write the story of the Great Story. The reasons for this historical approach are threefold: to demonstrate that accountability reporting is indeed a potent weapon on the public’s behalf; to show why its absence was so harmful during the mortgage era; and to secure its future in whatever journalism emerges from the digital disruption–because without accountability reporting, journalism has no purpose, no center, no point.

The first goal is especially important in order to rebut what I regard as facile criticisms, from both the political right and left and the digital-news advocates, that tend to dismiss all “mainstream media” as either hopelessly biased (as the right contends), uselessly timid (as the left has it), or just generally lame (as new-media enthusiasts believe). All three critiques may have some merit. Much of the old MSM indeed should be left by the wayside. But accountability reporting should always be understood as the core practice that defines and distinguishes American journalism.

Dean Starkman Dean Starkman runs The Audit, CJR’s business section, and is the author of The Watchdog That Didn’t Bark: The Financial Crisis and the Disappearance of Investigative Journalism (Columbia University Press, January 2014). Follow Dean on Twitter: @deanstarkman.