Stephen Moore of The Wall Street Journal editorial board hacks out an instant classic on how to mislead people with numbers.

The question-as-headline is your second red flag that this just might be a deeply disingenuous op-ed (the first is that it’s on The Wall Street Journal op-ed page):

A 62% Top Tax Rate?

The top marginal tax rate is just 35 percent now, of course. So how does Moore come up with the idea that Obama and the Democrats are pitching a 62 percent tax rate for the rich? Disingenuously.

First, here’s a classic example of misleading readers with an apples and oranges comparison:

If the Democrats’ millionaire surtax were to happen—and were added to other tax increases already enacted last year and other leading tax hike ideas on the table this year—this could leave the U.S. with a combined federal and state top tax rate on earnings of 62%. That’s more than double the highest federal marginal rate of 28% when President Reagan left office in 1989. Welcome back to the 1970s.

For Moore’s headline purposes he includes state taxes to get to 62 percent, but when he compare it to rates under Reagan, he doesn’t include state taxes.

The comparison is much more misleading than that, really. Moore is also including things like payroll taxes to come up with his fake 62 percent number, while not including them in that 28 percent Reagan figure. You can’t do that, boss.

Moreover, to come up with that doozy of a number, Moore is adding in not only state and payroll taxes, but just about every possible tax hike being bandied about by Democrats. But Moore knows full well that even if they wanted to, which they don’t, the Dems wouldn’t be able to enact every one of these. But he acts like they’re all coming.

Those theoretical and far-from-likely tax hikes include a 3 percent surtax on incomes over a million bucks; Obama’s proposal to end the Bush tax cuts for the rich in 2013, which would return marginal rates to 39.5 percent at the top; 3.4 percent Medicare taxes (Moore includes the employer’s contribution here); and 10.1 percent in additional payroll taxes because “Several weeks ago, Mr. Obama raised the possibility of eliminating the income ceiling on the Social Security tax” (that includes the employers’ share, too, though Moore doesn’t say that).

There’s also this:

Today’s top federal income tax rate is 35%. Almost all Democrats in Washington want to repeal the Bush tax cuts on those who make more than $250,000 and phase out certain deductions, so the effective income tax rate would rise to about 41.5%.

It’s unclear how Moore gets to 41.5 percent here. Repealing the Bush tax cuts would return the top marginal rate to 39.5 percent. Deductions affect effective tax rates, which are far lower than marginal rates. Since he doesn’t explain it, and since the backdrop is the rest of this misleading piece, I’m going to assume that this 41.5 percent number is false (I believe Moore is talking about the PEP and Pease taxes, but those don’t apply to people making more than $525,000, so they can’t be included in a total tax rate that includes a millionaire’s surtax.)

To get to 62 percent, Moore also includes 4 percentage points for state taxes. It’s unclear why he didn’t include local taxes while he was at it. That would have got him another full point (it’s always worth noting that state and local taxes are extremely regressive, taking 11 percent of the income of the lowest quintile of earners, which is more than twice what the top 1 percent pays.)

All this allows Moore to plant the zombie lie that Democrats are “proposing rates like those under President Carter.” Even with all his hocus-pocus, that’s not true, either. The top marginal federal income tax rate under Carter was 70 percent, a full eight percentage points higher than Moore’s fake number. If you include all the state and payroll taxes he uses to get to Obama’s “62 percent” figure, which you have to to make the comparison, that Carter number would be closer to 80 percent.

And again those are marginal tax rates. Unfortunately, most people don’t understand the difference between marginal rates, which is how much tax you pay on the last dollar you earn, and what people actually end up paying. The Carter administration didn’t confiscate 70 percent of rich people’s money in income taxes. The effective federal tax rate for the top 1 percent in 1979 was just 22 percent (including all taxes, particularly corporate income tax, the overall effective federal tax rate for the top 1 percent was 37 percent, well above 2007’s 30 percent rate, which is surely lower today.)

Then there’s this stunner:

Despite all of this, the refrain from Treasury Secretary Tim Geithner and most of the Democrats in Congress is our fiscal mess is a result of “tax cuts for the rich.” When? Where? Who? The Tax Foundation recently noted that in 2009 the U.S. collected a higher share of income and payroll taxes (45%) from the richest 10% of tax filers than any other nation, including such socialist welfare states as Sweden (27%), France (28%) and Germany (31%). And this was before the rate hikes that Democrats are now endorsing.

Moore’s logic: Since the U.S. collected a higher share of taxes from the richest 10% than other nations then that means we haven’t cut taxes for the rich. I don’t think I need to explain that one.

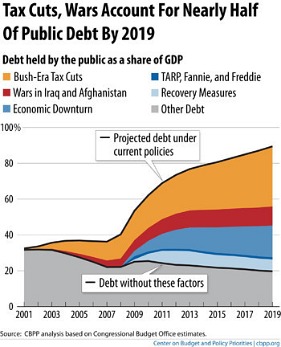

A couple of points I will make, though: The rich pay more taxes here because they get much bigger share of the income pie than their counterparts in Sweden, France, or Germany. And here’s a chart that shows how much of the debt comes from the Bush tax cuts of 2001 and 2003, which were extended for a couple of years by Obama late last year:

The folks on the WSJ edit page are no dummies. They know all this stuff. But spreading disinformation is just fine as long as it serves their larger purpose. And sure enough, the zombie lie is starting to spread.

It’s hit the heartland in a post by Milwaukee Journal-Sentinel columnist Patrick McIlheran, who uncritically parrots the bogus 62 percent number and doesn’t understand the concept of marginal tax rates:

Why is it, Stephen Moore asks in the Wall Street Journal, that Democrats think taking away two-thirds of someone’s income is sustainable policy?…

You can ask why it’s just that two-thirds of someone’s income vanishes, but Moore is practical: Will this help government fund itself?

Human Events spreads it. WSJ sister network Fox News does too, turning Moore’s question into a declarative “Dems Want 62% Top Tax Rate,” as does Moneynews.com and dozens of lesser blogs. CNBC and Larry Kudlow lend a hand:

Hey, throw enough stuff against the wall and something’s going to stick.

Reason No. 5,752 why you should never trust The Wall Street Journal‘s editorial pages.

Ryan Chittum is a former Wall Street Journal reporter, and deputy editor of The Audit, CJR’s business section. If you see notable business journalism, give him a heads-up at rc2538@columbia.edu. Follow him on Twitter at @ryanchittum.