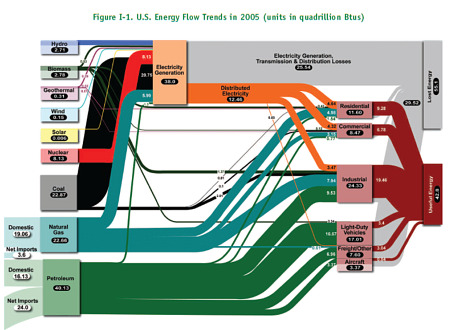

The Washington Post‘s Ezra Klein posts a fascinating graphic from the showing where our energy comes from and how it gets used and wasted, saying it’s “the clearest visualization of our energy economy that I’ve seen.” Indeed.

While we’ve long known that we get most of our oil from overseas now, foreign sources only account for about 28 percent of the total energy we use. I’d love to see this chart, which comes from the University of California, Lawrence Livermore National Laboratory, and the Department of Energy, with dollar figures attached. How much do we spend a year on oil, solar, nuclear, etc.?

What’s probably surprising to most folks about this graphic is just how much energy is wasted. Most energy generated (55 percent) never gets to an end user. Here’s where I disclose that my wife works for an energy-efficiency nonprofit.

(via Mark Kawar)

— The feds are stepping up the fight against the boiler room mortgage fraudsters. The LA Times reports they’ve charged more than 1,200 brokers and the like with fraud in the last few months.

The announcements, coupled with the arrest Tuesday of the former chairman of a large Florida mortgage company on charges of engineering a $1.9-billion fraud, illustrate the two levels of misconduct the government is going after.

Cases like those publicized Thursday are relatively easy to investigate and prosecute, former federal prosecutor John Hueston said. But not always that easy: Separate civil charges were announced against 395 people and companies, suggesting to Hueston that the government had decided not to bring criminal charges in those cases.

Good news. There’s a lot of rot to be cleared out in that industry.

— The Wall Street Journal‘s David Wessel points to a study by the IMF that says by one measure, the current crisis is the worst in U.S. history.

The upshot? While the total number of bank failures is lower than in past events like the S&L Crisis, banks have gotten so big that if you measure it by their share of deposits, “2009 is by far the worst on record.”

Failed banks account for 26 percent of total deposits if you include banks like Citigroup and Bank of America that would have failed if not for Uncle Sam.

All the more reason to break up the too big to fail banks.

Ryan Chittum is a former Wall Street Journal reporter, and deputy editor of The Audit, CJR’s business section. If you see notable business journalism, give him a heads-up at rc2538@columbia.edu. Follow him on Twitter at @ryanchittum.