Jean Eaglesham had a nice get—an exit interview with the outgoing enforcement chief of the Commodity Futures Trading Commission, who complains the agency is underfunded.

Right. Aren’t we all? That’s usually the problem with stories like this. The question of appropriate funding levels for a regulator is not only esoteric, it’s necessarily murky and impossible to demonstrate. How much is enough? If a case isn’t made, who would ever know?

As a result, there will always be someone, like Scott O’Malia, to argue against “unsubstantiated appeals for massive budget increases.” One person’s modest is another’s massive.

What’s notable about this piece is that it brings some evidence to support this critically-important-but-hard-to-prove assertion.

For one thing, the outgoing chief, David Meister, goes so far as to name the names of individuals who, but for budgetary constraints, might have been charged by the agency, but weren’t. These are two former JP Morgan traders who figured in the scheme to hide massive losses in the “London whale” trading scandal.

The funding squeeze is forcing the CFTC to make “some very tough choices” about its work, Mr. Meister said. One example: the agency’s decision not to charge Julien Grout and Javier Martin-Artajo, the two former J.P. Morgan traders accused by the government of hiding multibillion-dollar losses.

Edward Little, a lawyer representing Mr. Grout, said it was “shocking” the CFTC said it could have charged his client, “given that all the trading was done by the government’s own cooperator, Bruno Iksil, the London whale himself.” A spokeswoman for Mr. Iksil’s lawyers declined comment on this statement.

A lawyer for Mr. Martin-Artajo didn’t respond to a request for comment.

Now, it’s true that Grout and Martin-Artajo have since been charged civilly by the Securities and Exchange Commission and criminally by the Justice Department. But the government’s use of overwhelming force —with multiple agencies piling on charges—is a key part of its M.O. in white-collar cases and a not-insignificant deterrent for would-be offenders. This is the kind of shock-and-awe that gets Wall Street’s attention. Plus the fact that the two were charged elsewhere is the biggest reason why Meister could name them at all. The example lends added credibility to outgoing CFTC Chairman Gary Gensler’s claim elsewhere in the story that some investigations are shelved altogether for budget reasons.

What’s more, we learn that the CFTC is the rare agency that pays for itself, and then some. When Dutch lender Rabobank became the fifth firm to admit to rigging LIBOR rates, the total of sanctions in the probe, begun by the CFTC in 2010, reached $1.8 billion. As the Journal notes, that’s nine times the CFTC’s annual budget of $195 million.

We also learn the CFTC has all of 155 officials in its enforcement division (compared to 1,200 at the SEC), 10 percent fewer than three years ago and about the same number as 11 years ago.

The agency, a Watergate-era creation, has always been the redheaded stepchild of financial regulation, best known for being stepped on by more powerful political forces, as when famously Alan Greenspan, Robert Rubin, and the SEC Chairman Arthur Levitt shouted down the agency’s then-chair, Brooksley Born, in her effort to regulate the over-the-counter derivatives market in the late ’90s. It was Born whom Larry Summers ominously informed on a phone call that he had “13 bankers” in his office warning of global calamity should regulation be allowed. Of course, global calamity resulted to a large extent because it wasn’t allowed.

Indeed, it’s interesting to go back and read the Financial Crisis Inquiry Commission’s account of the political bludgeoning the CFTC took back then (pp 47-48), with Rubin, Greenspan, and Levitt going so far as to issued a joint statement denouncing a CFTC’s “concept release” about possible regulation: “We have grave concerns about this action and its possible consequences” etc. etc.

And then the Commodity Futures Modernization Act of 2000 in essence deregulated the OTC derivatives market and eliminated CFTC oversight (along with that of the SEC).

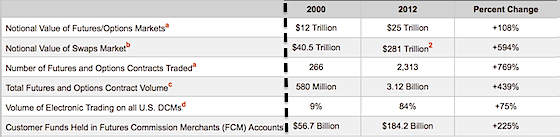

So while the agency’s staffing levels are the same as a decade ago, the size of the markets it’s supposed to cover have done this:

Bottom line, a murky subject is now a lot clearer.

Dean Starkman Dean Starkman runs The Audit, CJR’s business section, and is the author of The Watchdog That Didn’t Bark: The Financial Crisis and the Disappearance of Investigative Journalism (Columbia University Press, January 2014). Follow Dean on Twitter: @deanstarkman.