Jesse Eisinger and Jake Bernstein of ProPublica have a fantastic investigation out today of Magnetar, a short-selling hedge fund that inflated the bubble by getting toxic CDOs created and betting against them. Not only did it help create the CDOs, it pushed to make them as toxic as possible.

This is a helluva lede, if ProPublica can back it up:

In late 2005, the booming U.S. housing market seemed to be slowing. The Federal Reserve had begun raising interest rates. Subprime mortgage company shares were falling. Investors began to balk at buying complex mortgage securities. The housing bubble, which had propelled a historic growth in home prices, seemed poised to deflate. And if it had, the great financial crisis of 2008, which produced the Great Recession of 2008-09, might have come sooner and been less severe.

At just that moment, a few savvy financial engineers at a suburban Chicago hedge fund [1] helped revive the Wall Street money machine, spawning billions of dollars of securities ultimately backed by home mortgages.

And it can. Magnetar in three critical months in late 2006, after it had become clear that the housing bubble had popped, was just about the only player in the mezzanine CDO market—a critical one for keeping the whole toxic-asset machine running.

The problem was nobody wanted the equity tranche, which is the riskiest part of the capital structure. That lack of demand could presumably have shut much of the machine down. But Magnetar, in cahoots with Wall Street banks like JPMorgan Chase, Citigroup, and Merrill Lynch, and CDO managers, had CDOs created so it could bet against them.

Magnetar’s purchases solved a crucial problem for the banks. Since the equity was so risky and thus difficult to sell, banks didn’t like to create new CDOs unless someone committed to buy them. Indeed, such buyers were so crucial that Wall Street referred to them as the CDOs’ “sponsors.”

Without sponsors, Wall Street’s mortgage bond assembly line could grind to a halt, and with it bank profits and banker bonuses…

“It seemed like a miracle,” says one mortgage market investment banker, because “no one” had been buying equity.

“By the end of 2005, the general sense was that the CDO market would slow down. These trades continued to fuel the fire,” says Bill Tomljanovic, who worked for a firm that helped build a Magnetar CDO. Magnetar was “a driving force in the market.”

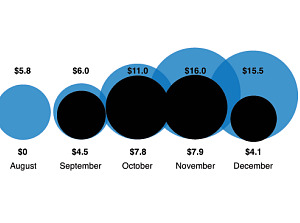

Take a look at this chart, which shows that $20.2 billion out of $33 billion of the mezz CDOs created in the critical September to November stretch of 2006 were sponsored by Magnetar (click for full graphic).

Here ProPublica explains how Magnetar’s short-selling distorted the market:

Such short bets can be helpful; they can serve as a counterweight to manias and keep bubbles from expanding.

Magnetar’s approach had the opposite effect — by helping create investments it also bet against, the hedge fund was actually fueling the market. Magnetar wasn’t alone in that: A few other hedge funds also created CDOs they bet against. And, as the New York Times has reported, Goldman Sachs did too. But Magnetar industrialized the process, creating more and bigger CDOs.

In stocks, short sellers can’t create a bad company and short it (well, actually, I haven’t heard of that, but I wouldn’t put it past somebody!), but in the CDO market, they could.

Reading this story just makes your stomach turn. This is one of the most egregious, cynical things yet dug up in the crisis.

And Magnetar pushed managers to dump the most toxic stuff they could find into the CDOs it sponsored, carefully avoided legal responsibility for the inevitable wreck, though Lord knows, let’s hope somebody can find something it overlooked:

Prusko and his boss at Magnetar, Snyderman, began approaching investment banks, offering to buy the riskiest, highest-yielding portion of CDOs. They always wanted a middleman, known as a CDO manager, on their deals…

By relying on a manager rather than managing the deal itself, Magnetar had no legal obligations to the CDO or others who bought it.

How bad an actor was this company? It’s actually sparked a contrition sighting on the Street!

Some bankers involved in the Magnetar Trade now regret what they did. We showed one of the many people fired as a result of the CDO collapse a list of unusually risky mortgage bonds included in a Magnetar deal he had worked on. The deal was a disaster. He shook his head at being reminded of the details and said: “After looking at this, I deserved to lose my job.”

If you want to know how credit-default swaps fueled the crisis, here you go:

Outsiders thought Magnetar was piling in at exactly the wrong time. A March 2007 Business Week article titled “Who Will Get Shredded?” would later put Magnetar near the top of its list. The hedge fund, said the magazine, “showed bad timing.”

How could Magnetar hope to make money on such risky stuff? It had a second bet that was known only to insiders.

At the same time it was investing in the equity, the fund placed bets that many of the same CDOs it had helped create would actually blow up. It did that using one of the most opaque corners of the investment world: credit default swaps, which function as a kind of insurance on CDOs and other types of bonds.

One of the problems with CDS is it can be compared to taking out insurance on somebody else’s house, which gives you an incentive for it to burn. What Magnetar was doing here was like taking insurance out on your own house and then building it out of matchsticks.

There’s much more here. And This American Life and Planet Money will have more this weekend, including, bizarrely, “an original Broadway-style song that helps explain the story and was specially commissioned for this program.”

Magnetar, as ProPublica says, wasn’t alone in doing this: Goldman’s infamous Abacus deal stands out, and there are others. But Magnetar was the driver here.

A few avenues for reporters to explore:

— How did Magnetar’s mezzanine CDOs ripple throughout the market? In other words, how many other non-mezz CDOs did it enable? And were these repackagings of existing securities or were new home mortgages created to fill them?

— If mortgages were created to fill them, how did Magnetar’s demand for the worst securities filter down to the home market? Can you trace the downward spiral all the way down to the mortgage broker and specific borrowers who got hosed?

— During the last months of 2006, especially from September to November, Magnetar dominated the mezzanine-CDO market. It didn’t after that. Did others figure out its strategy and copy it?

— The shadow-banking system looks like it’s going to remain almost completely unregulated. This shows pretty conclusively why it shouldn’t. There are lots of stories to be had here.

It’s worth noting, as ProPublica is good to do, that some of the spadework on Magnetar was done by Yves Smith in her new book and by The Wall Street Journal a couple of years ago (ADDING: And the Times, on Goldman). Plaudits to all around.

For more on Eisinger, an Audit favorite, see my interview with him from late 2008.

Ryan Chittum is a former Wall Street Journal reporter, and deputy editor of The Audit, CJR’s business section. If you see notable business journalism, give him a heads-up at rc2538@columbia.edu. Follow him on Twitter at @ryanchittum.