Sign up for the daily CJR newsletter.

Here’s a headline you don’t like to see if you’re worried about a possible social-media/tech bubble:

Slate wrote this toward the end of March:

Candy Crush’s Terrible Market Debut Shows We’re Not in a Tech Bubble

The stock performance of one company among thousands doesn’t show much of anything, much less that tech valuations are reasonable.

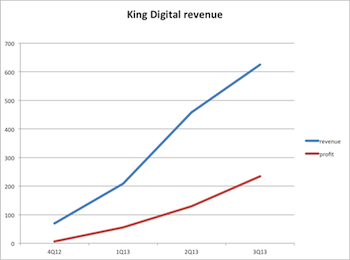

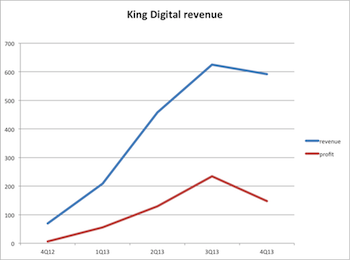

Particularly when that company is not a growth stock. King Digital Entertainment, a UK social-gaming outfit caught lightning in a bottle with the game Candy Crush Saga but the fad is already fading. King’s big mistake was taking a quarter too long to launch its IPO, which means instead of its charts looking like this:

They looked like this:

Candy Crush parent King Digital couldn’t sell an exponential growth story, and its stock dropped 16 percent on its first day of trading. It’s a good thing that not every IPO soars—it would be a sure sign that something was wrong if they did—but it’s hardly a sign that there’s no tech bubble. King ended up still valued at $7 billion even as its (considerable) net income was already plummeting and revenue was beginning to slide.

And there were lots of tech IPOs that faltered back before the dot.com bubble popped, but the bubble kept expanding anyway. When it burst it wiped out trillions of dollars of wealth that had often been moved from safer and/or more productive areas and hit regular investors—aka the “dumb money”—particularly hard.

Take 1-800-Flowers.com for instance. It never closed above its August 1999 IPO price and was down 29 percent two weeks after it went public. Its shares today are down 81 percent in real terms.

But August 1999 was well before the most damaging stage of the dot.com bubble. The Nasdaq doubled between then and March 2000, before plummeting 76 percent over the next two-and-a-half years. Even now, 14 years later and five years into an enormous bull run, the Nasdaq is still 16 percent below its 2000 levels, and 38 percent lower if you adjust for inflation:

Don’t get me wrong, while there have been clear signs of speculative fever, this is not 1999 all over again. The valuations aren’t nearly as insane, many or most of the businesses are actually businesses, and much of the action has shifted to private markets. So far, anyway.

Actually, right now we’re in the middle of a significant downturn for tech stocks, though it’s far too early to tell whether it proves to be the breaking of the fever or just a short-term correction before it shoots up again. Facebook, LinkedIn, Pandora, Netflix, and Twitter are all down between 18 and 31 percent over the last month (as are Zynga and Groupon, whose stocks flamed out long ago). That’s brought Facebook’s P/E down to 86, LinkedIn’s to 730, and Netflix’s to 183. Twitter and Pandora lose money, so they don’t have any “E.” Even Amazon has sold off 15 percent over the last month. The 20-year-old company’s P/E is now a mere 543.

Perhaps investors were spooked by a company valued at 100 times earnings buying a company valued at 950 times sales, which is what happened when Facebook bought WhatsApp for $19 billion.

Or maybe the Coupons.com IPO made the echoes of the dot.bomb era impossible to ignore.

Two weeks before the Candy Crush IPO went sideways, Coupons.com—one of those late 1990s dot.coms that didn’t get to go public before the bust—skyrocketed 103 percent on its debut, despite never having posted an annual profit in its more than 15 years of existence. Bloomberg View’s Jonathan Weil marveled:

This is one of those days where I realize I don’t understand anything about finance or capital markets. I’m a dinosaur. I don’t get it. People are saying things like “this time is different” again in news articles about initial public offerings by Internet companies, and they mean it. All I can do is watch, dumbfounded.

Coupons.com has nosedived since then, shedding 38 percent.

Even after the recent correction, though, the Nasdaq’s average P/E is still at 32, nearly double that of the S&P 500.

What I’m concerned about is how the intellectual groundwork (so to speak) for a potential final phase of a bubble is laid.

Daniel Gross, who wrote an, uh, ill-timed book in 2007 extolling the benefits of bubbles, did make an interesting point the other day about the various stages of bubble formation:

… a few solid years of impressive fundamental growth give way to highly ambitious projections and world-changing proclamations; a host of new entrants run onto the field, oblivious to profits or many of the other basics of running a business; individuals and naïve corporations start to get in on the action with bold, aggressive moves; and in the most dangerous stage, the phenomenon crosses over into popular culture–i.e. from CNBC to NBC.

And right on cue, here comes USA Today touting IPO jumps (“GrubHub IPO jumps a tasty 31%”) and talking about metrics created by Silicon Valley (see: adjusted earnings before interest, taxes, depreciation, and amortization) that magically turn losses into profits not recognized by Generally Accepted Accounting Principles.*

Which brings us to another recent headline, this time in Fortune:

Tech IPOS: Profits don’t matter

Fortune here writes about Box, a cloud-storage company that filed for an IPO two days before Slate’s piece and which spends more on marketing than it reaps in sales. Fortune writes that investors are only focused on growth and “total available market” and that:

… my overarching point remains: Profits do not decide a company’s success or failure in the public markets. If they did, growth-focused Amazon wouldn’t be trading at more than $350 per share.

The Amazon example also is instructive for one other reason: Many of these tech issuers — particularly the enterprise tech ones — could be profitable if it was somehow required. They’d probably shrivel up and eventually die, but it technically could be done (as opposed to investing into future growth). This is a key difference between today’s tech IPO market and the dotcom boom — where many of the frothiest companies had no underlying business to fall back on if times got lean. You may disagree with the notion of revenue growth trumping profitability — and it’s a near certainly that valuations will eventually fall, leaving many tech IPO investors with losses — but at least today’s buyers are looking at those metrics, instead of something like “eyeballs.”

But there’s a bit of a disconnect here. What does it say about a company’s value that it is unable to make profits, and that any changes required to generate profits would rob it of investment capital and eventually cause it to shrivel up and die? That’s different from the late 1990s in that profits are at least theoretically possible, I suppose, even if only temporarily. But still, that’s a long way from reasonable valuations based on expected future earnings.

No two bubbles are the same and you’d be hard-pressed to top the one we saw in the 1990s, much less the housing bubble of the 2000s.

Back in 1999, we had not just unsustainable valuations but the wild-eyed cheerleading that purported to justify them, including the infamous Dow 36,000, where American Enterprise Institute think-tankers said stocks were undervalued by two-thirds and that P/E ratios would be fairly valued at 100.

But even they had nothing on Wired founding editor Kevin Kelly, who in September 1999 wrote perhaps the most insane piece of the entire dot.com bubble. Kelly wrote that the Dow would be above 50,000 by 2010, a prediction that was off by 40,000 points or so.

It’s fascinating in retrospect to see how aware Kelly is of the craziness he’s amidst but how he’s able to brush it off:

The beginning of every previous boom has hatched prophets claiming that “this time is different.” Immediately after these claims are made, the market crashes. But sometimes, things really are different.

And so he predicted:

Fast-forward to 2020. After two decades of ultraprosperity, the average American household’s income is $150,000, but milk still costs only about $2.50 a gallon. Web-enabled TVs are free if you commit to watching them, but camping permits for Yellowstone cost $1,000. Almost everyone working has signed up for a job that does not exist (at the moment); most workers have more than one business card, more than one source of income. Hard-hat workers are paid as much as Web designers, and plumbers charge more for house calls than doctors. For the educated, the income gap narrows. Indeed, labor is in such short supply that corporations “hire” high school grads, and then pay for their four-year college educations before they begin work.

What the rich have in the year 2000, the rest have in 2020: personal chefs, stay-at-home moms, six-month sabbaticals.

As best as I can tell, we’re not seeing anything quite like this yet. It may in fact, be impossible to be wronger than Kevin Kelly was 15 years ago.

So maybe it is different this time. But in trying to find similar thinking out there that could be preparing the ground for our era’s mania, you don’t have to look far.

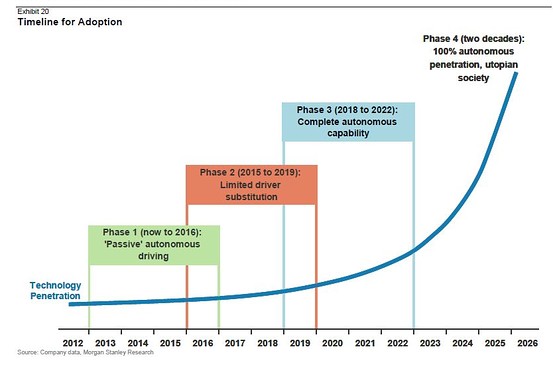

Here’s a chart from an actual Morgan Stanley presentation on the ultra-bull case for Tesla Motors, the innovative and very richly valued electric car maker:

Yes, that says “Phase four (two decades): 100% autonomous penetration, utopian society.” As The Wall Street Journal‘s Tom Gara pointed out, Morgan Stanley “uses the word ‘utopian’ 11 times — each of them in a sincere, non-ironic way” in its report.

The FT’s Izabella Kaminska calls this an example of Silicon Valley’s “God complex,” and she’s not exaggerating their thinking:

But what we’re dealing with now is arguably a new level of scary entirely. Google has transcendentalists like Ray Kurzweil on their payrolls openly pursuing eternal “cloud-based” life, robot armies and AI — most of it, if not all, facilitated by their exclusive ownership and access to an ever growing global organic dataset (G.O.D.), that one day has the capacity to be all-knowing not only about the here and now, but about the probability of your consuming a cheese sandwich at tea-time next Thursday.

Google has plenty of cash to play with, and bored cash-rich companies that don’t really care about returns can invest in the craziest of things. This is especially so if they have the power to mint their own cash in the form of overly inflated stock prices, the product of cult-like investor appeal, which can be used as acquisition currencies in their own right to stifle the competition or buy it out.

Is it any surprise then that techland is consequently displaying delusions of godhood all round?

Ever think you’d read three paragraphs like that in the Financial Times?

Google has effectively signaled that it’s pursuing nothing less than immortality. It has hired Ray Kurzweil as its director of engineering. Kurzweil is the chief proponent of the Singularity, which posits that very soon, computer intelligence will overtake human ability and either merge with or supplant mankind. Kurzweil is actively working to make this happen, and Google is snapping up every robotics company it can find.

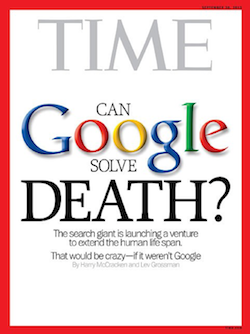

And so we get magazine covers like this:

And headlines like “Google’s New A.I. Ethics Board Might Save Humanity From Extinction” in the Huffington Post and “Facebook Buying Oculus Isn’t The End of The World, In Fact, It’s the Opposite” on a sight aptly called Bright Side of News. And “Hungry hi-tech giants: Are Google and the gang really getting ready to take over the world?” in The Independent, and “Fly me to the moon: Oculus Rift is just the beginning,” in The Week, and “How You’ll Fund — And Wildly Profit From — The Next Oculus Rift” in Wired, and “Will Minecraft and Makerbot usher in the post-scarcity economy?” at Boing Boing.

Take some real technological trends, add the tech industry’s staggering hype machine, mix in the press’s need for sensational headlines to drive clicks, and you have the makings of the next big one.

* I updated this paragraph for clarity

Has America ever needed a media defender more than now? Help us by joining CJR today.