Bloomberg’s Carol Hymowitz profiles a retired Oral-B marketing director who at 77 is working two jobs flipping burgers and handing out samples at Sam’s Club.

We’ll be seeing a lot more of this with the coming wave of Baby Boomer retirees—the first generation hit with the enormous policy failure that is the decline of pensions and the rise of the 401(k):

Low-income Americans have long had to scrape by in old age, relying primarily on Social Security. The middle class, with its more educated and resourceful retirees, is supposed to be better prepared, with some even having the luxury to forge fulfilling second acts as they redefine retirement on their own terms. Or so popular culture tells us.

The reality is often quite another story. More seniors who spent much of their careers as corporate managers and professionals are competing for low-wage jobs. For these growing ranks of seniors with scant savings, it’s the end of retirement.

About 7.2 million Americans who were 65 and older were employed last year, a 67 percent increase from a decade ago, according to government data. Yet 59 percent of households headed by people 65 and older currently have no retirement account assets, according to Federal Reserve data analyzed by the National Institute on Retirement Security.

This is going to be a huge problem for at least two or three decades. We need a lot more coverage like this Bloomberg piece.

— American Banker‘s Maria Aspan and Victoria Finkle report that banks are pressing their luck pushing predatory “services” like credit monitoring and payment protection. The Consumer Financial Protection Bureau has issued more than half a billion dollars in fines to American Express, Discover, and Capital One, and the Banker writes that more are coming.

Specifically, American Express has swapped one add-on service for another, while Wells Fargo (WFC) and Citigroup (NYSE:C) are continuing to offer forms of payment and identity theft protection. All other top-tier U.S. credit card lenders have stopped marketing add-ons credit card services online to new customers, Corporate Insight says.

American Express has halted sales of identity theft protection. However, in recent months it has been offering customers a similar “credit monitoring” service provided by Experian. Customers are charged a $1 sign-up fee and $14.99 per month. In exchange, the service provides customers with versions of their credit scores from the three largest credit bureaus and email alerts about any “key changes” to their credit files…

For banks willing to run the reputational risk, the economic appeal of add-ons is clear–even if they incur regulators’ wrath. At Discover, for example, the CFPB’s $214 million card add-on settlement was eclipsed by the $234 million it made from the products in 2010 alone. If American Express, Wells or Citi are eventually fined similar amounts, that would likely be far less than each has earned from add-ons.

Good reporting by the Banker.

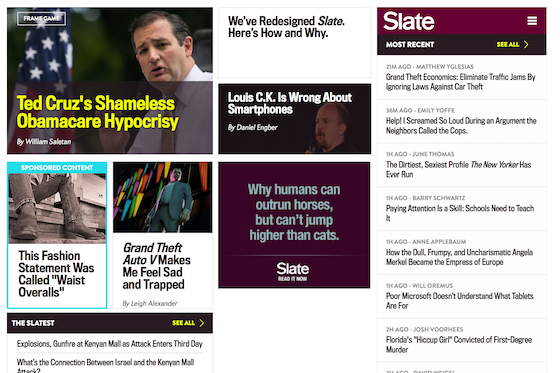

— Slate unveiled a radical redesign of its site yesterday.

I couldn’t put my finger on what was so disconcerting about it, but Lindsay Beyerstein nails it on Twitter:

Ryan Chittum is a former Wall Street Journal reporter, and deputy editor of The Audit, CJR’s business section. If you see notable business journalism, give him a heads-up at rc2538@columbia.edu. Follow him on Twitter at @ryanchittum.Slatepitch: Let’s redesign our site to make everything look like sponsored content.