I’ve criticized DealBook a fair amount lately, so I want to flag this good piece that questions why authorities have failed—yet again—to do anything about senior Wall Street executives implicated in wrongdoing.

Peter Eavis:

It’s an outcome that has vexed the public since the financial crisis of 2008.

The government says there is wrongdoing at a large bank and makes it pay a fine. But senior executives who seemed to play a role in the missteps are not singled out for individual punishment.

It happened again on Thursday, when regulators in the United States and Britain hit JPMorgan Chase with nearly $1 billion in fines for the bank’s failure to properly handle a trading debacle last year…

After a faltering start in early April, the senior executives stepped up internal efforts to determine what was going on in the chief investment office, the unit that had made the troubled trades. But, according to the two agencies, the senior executives did not fully describe the severity of the investment office’s problems in a securities filing that came out on May 10.

The filing had to be revised later. Such changes are considered serious because investors expect those filings to provide accurate information.

— Senate bulldog Carl Levin wonders about this too, telling the Financial Times that “The whole issue of misinforming investors and the public is conspicuously absent from the SEC findings and settlement.”

The FT writes that regulators “slammed” JPMorgan’s top executives for the fiasco.

Unfortunately, the good piece is marred by this quote:

But Jonathan Macey, a law professor at Yale University, said the SEC was overstepping its role. “[What] bothers me about this is that the government is saying, ‘We the government are going to tell you how to do internal controls’. I don’t know anybody who thinks that the government in general and in particular the SEC is any paragon of efficiency with respect to internal controls and quality of management.”

It’s probably worth noting that Macey is a Cato Institute type who wrote a book blaming the loss of integrity on Wall Street on… you guessed it: regulators!

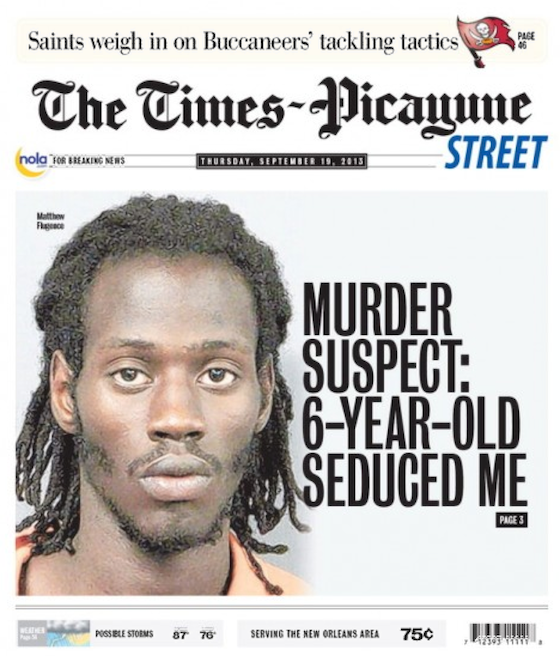

— The Times-Picayune launched a new tabloid edition on its non-print days a few months ago to compete with the upstart New Orleans Advocate, which had swiped many of the TP’s best journalists and promised readers a print paper seven days a week.

I don’t think anyone thought the format would cause the Times-Picayune to go full Murdoch, but here’s the front page from yesterday:

Letting a murder suspect blame his 6 year old victim on the front page—in a bid to sell more papers—is just very bad judgment.

Ryan Chittum is a former Wall Street Journal reporter, and deputy editor of The Audit, CJR’s business section. If you see notable business journalism, give him a heads-up at rc2538@columbia.edu. Follow him on Twitter at @ryanchittum.