A Debit to Fortune for journalistic laziness and reckless stenography in its interview with Aetna CEO Ron Williams in which he “defends the U.S. health insurance industry.”

While we understand Williams desire to offer “a defense,” we don’t understand why Fortune believes it can abdicate its responsibility even to explain the charges.

Allow us to: a dysfunctional market has led to massive insurer inefficiency and waste. That’s the charge, anyway.

Fortune, though, has a bad habit of going overboard to provide friendly forums to interview subjects. A Q&A need not mean lobbing easy questions and leaving weak answers unchallenged.

Williams, for instance, compares uninsured Americans to bank robbers. No kidding:

Today we all pay for the uninsured. If an individual sticks up a bank and walks off with $25,000, there are consequences. If someone who really could have had an insurance policy consumes $25,000 worth of health care, everyone else pays for that.

Fortune finds it’s impolite, apparently, to challenge this grotesque analogy. The idea that the underinsured are employing a strategy to win free healthcare is bizarre, never mind that they tend to be sicker and more likely to die early than those with insurance.

But if Williams is fool enough to believe that sliming the uninsured is a good PR strategy, good luck to him. Fortune’s job, on the other hand, is not to take dictation but to provide some intellectual rigor to the discussion.

Williams, for instance, makes health coverage-for-all sound almost easy—if only people would fork over the money required to buy it.

Forty-seven million Americans are uninsured. And Williams dismisses 30 to 33 million of them as easy to cover without any tax credits or subsidies: people who are eligible for

government coverage but haven’t signed up, college kids, non-citizens here legally, and

people with household incomes over $75,000.

How would these people get coverage? Williams doesn’t say, and, of course, Fortune doesn’t ask. But the implication that with the poor covered by the government every one else can afford to pay for themselves is flatly false.

Take a look at Aetna’s own price list. Aetna’s policy for individual family coverage in New York City costs more than—get this—$33,000 a year.

So a salary of $75,000—which, by the way, is well over the city’s median income —isn’t going to get it done, is it, Fortune?

And here’s a chilling stat from a report by the National Coalition on Healthcare:

Retiring elderly couples will need $200,000 in savings just to pay for the

most basic medical coverage [according to Fidelity Investments]. Many experts believe

that this figure is conservative and that $300,000 may be a more realistic

number.

So start saving.

And all this is beside the fact that sometimes insurance is so poor that even the insured don’t have coverage, as a Wall Street Journal story we like (subscription required) said and which we described here last week.

Even more problematic is the incredible waste that plagues the U.S. healthcare

system. The Fortune interview briefly raises this point, but then the interviewer doesn’t sufficiently grill Williams about the 11 percent of revenues he acknowledges Aetna spends on sales and administration.

Eleven percent of premiums. For what? But it’s worse than that.

Paul Krugman in a September 2006 New York Times column headlined “Insurance Horror Stories” pegs the real costs:

…we’re paying the price for pointless, destructive reliance on private insurers. Medicare, which is a universal health insurance program for older Americans, spends less than 2 cents of every dollar on administrative costs, leaving 98 cents to pay for medical care. By contrast, private insurance companies spend only around 80 cents of each dollar in premiums on medical care; much of the remaining 20 cents is spent denying insurance to those who need it.

The watchdog group Public Citizen in 2003 pointed to two studies showing the price we all pay for healthcare administration:

Bureaucracy in the health care system accounts for about a third of total U.S. health care spending—a sum so great that if the United States were to have a national health insurance program, the administrative savings alone would be enough to provide health care coverage for all the uninsured in this country, according to two new studies.

Those studies are from The New England Journal of Medicine and Harvard University, along with Public Citizen.

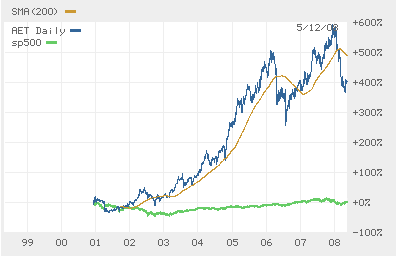

While you’re thinking about that and other things Fortune didn’t tell you, ponder Aetna’s share price in recent years compared to the rest of the economy as measured by the S&P500 (the green line), courtesy of the WSJ:

Adweek shines

A credit to Adweek for a great piece on a misleading ad campaign designed by a group of college students who took a class sponsored by handbag-maker Coach.

Reporter Andrew Adam Newman gives us a lively and thought-provoking take on what could have been a dry topic: the problems the Internet poses for truth-in-advertising and corporate ethics.

Newman first introduces us to Heidi Cee, a young woman anxious to find a Coach bag she had lost. She posted flyers around Hunter College, directing people to her blog and Facebook profile and offering students a reward if they found it.

A student returned the bag and claimed the $500 reward, but Cee discovered the bag was a knockoff. So $500 short and with one fake Coach bag too many, Cee decided to research the origins of counterfeits and tell her Internet audience what she found. Terrorism. Crime. Child labor.

The catch? Cee is a counterfeit herself.

A public relations class at Hunter invented her last spring. The course was funded by a $10,000 grant from Coach and was part of a college outreach campaign by the International AntiCounterfeiting Coalition (IACC), a trade group that includes Coach and other brands like Apple, Levi Strauss & Co., Louis Vuitton and Rolex.

One of the reasons this story is so interesting is that unlike many other online frauds—like the recent ruse by the CEO of Whole Foods—the world of advertising has different standards of truthfulness. Different from, well, everybody else. When is it ethical to lie in a business that has long been, as the article points out, “largely a game of pretend”?

Not this time. Even PR professionals have criticized the Coach campaign for violating industry ethics.

An editorial out of bounds

A Debit to The Wall Street Journal for a tasteless editorial attacking the late Ohio Senator Howard Metzenbaum for… moving to Florida in his old age.

“Senator Snowbird,” the headline quips, “RIP.”

The Journal, apparently with a direct line to the recently deceased, tells us Metzenbaum moved to Florida from Ohio in 2002 “to avoid his state’s death tax” and to avoid “paying his home state’s income tax (top rate: 6.55%).”

What, you may wonder, is the Journal getting at? It turns out that the elderly ex-Senator’s move to Florida is “a teaching moment in tax policy.” As in: the estate tax is bad.

Look, if the economic royalists on the Journal’s editorial board want a tax policy that Marie Antoinette might have written, chacun a son gout. But it’s a journalistic error to assume that an elderly public figure’s move to Florida from Ohio was tax-driven—at least the Journaldoesn’t let on that it has any evidence. We hear lots of people like the weather down there.

And it’s beyond the bounds of civilized discourse to use a man’s death as an occasion to score cheap political points. Whatever the merits of the policy question, that’s a disgrace.

Good subject; weak execution

A Debit to Forbes for a profile of News Corporation president Peter Chernin that recycles old information and misses news in a story about Chernin aggressively steering Fox toward the Internet.

This story isn’t new. Fortune, for one, identified it in an intriguing 2006 profile of Chernin. We’re not saying that if a magazine publishes one profile the story is done—and the idiosyncratic, successful Chernin is a good subject. But subsequent profiles should add to our understanding of him and of Fox and News Corp.

In fact, since 2006 there has been a key extension of Fox’s Internet strategy. Hulu, its Web-based TV service, is its big new thing, as Forbes notes, but other outlets have done smarter pieces already. Both Slate’s “Hulu Hoopla” and Fortune’s piece on the business negotiations behind the site each offered more rigorous analysis than did Forbes, which at one point asks, “Will Internet revenue make up for the decline of DVD and cable TV?”

The fact is, you can only get away with asking these kinds of open-ended questions if you can spark interest while we all wait for the answers. And for that, we need more ideas and more information than Forbes gives us. Information like the mechanics of MySpaceTV, examined in the May 12 edition of BusinessWeek. Or ideas like Chernin’s warning last year “that industry watchers might overestimate the business opportunity behind user-generated content.”

Both of these pieces will help readers to understand news that came out just after the Forbes story. Fox Interactive Media’s revenues were 10 percent below expectations on problems with advertising at MySpace.

The Forbes piece may have come out just before this news, but its insufficient analysis of Chernin’s Internet strategy doesn’t prepare readers for it.

DMN scores on a local icon’s fall

A Credit to The Dallas Morning News for a nice story on the mismanagement, and ultimate collapse into bankruptcy, of a prominent local business.

The money men arrived with plans to ramp up sales and lure customers with more upscale tastes. Instead, their stewardship coincided with a long slide, which culminated in Home Interiors’ Chapter 11 bankruptcy filing on Tuesday.

‘My question is, how can something so good turn to something so bad in such a short period of time?’ said Don Searcy, who took a job sweeping floors and cleaning bathrooms at Home Interiors in 1960, then rose to become its vice president and general manager before retiring in 2000.

In an extensive, thoughtful piece, reporter Brendan Case answers Searcy’s question.

This is the kind of reporting that should be the backbone of local and regional business sections. And investing in it is one way to shore up those sections, rather than cutting them down.

Political coverage lite

A Debit to the FT for Wednesday’s front-page story on the primaries saying, well, not much. (The paper posted a slightly different, but not much more informative, version online under the same headline: “Obama keeps Clinton at bay.”)

On the cover, next to an enormous headshot of Obama drinking beer, we get six paragraphs, bylined “FT Reporters.” The piece tells us of Obama’s win in North Carolina and Clinton’s early lead in Indiana.

That the paper’s deadline was too early for definite results from Indiana heightens the sense that the tiny piece, with a file photo twice as big as the text and no reporters’ names attached, is merely filler.

Filler on page 19 is one thing. But this is page one.

Unsupported hype for an auction

A Debit to The New York Times for spinning one of its spring art auction pieces incorrectly.

Here’s the headline from Wednesday’s Times piece on Christie’s: “Sale Results of Impressionist and Modern Art Exceed Expectations at Christie’s.” And the lead paragraph:

Fears that the Christie’s sale of Impressionist and modern art would usher in a market meltdown were assuaged early Tuesday evening when everything from a Monet landscape to a monumental sculpture by Rodin brought record prices.

So you’re probably thinking the Christie’s sale went well. Unless you read to the end of the second paragraph, which says:

While the evening’s bidding was lively, the sale totaled $277.2 million total, shy of its $286.8 low estimate.

Granted, the sales could have been far worse, but the headline contradicts the facts.

We looked at some other outlets for comparison. We liked a Bloomberg piece headlined “Record Monet Fails to Stem Dip in Christie’s Impressionist Sale.”

Monet and Rodin failed to prevent Christie’s International from missing its low estimate for an evening impressionist and modern art auction for the first time in four years.

Not that the auction was all bad news for Christie’s. But it was mixed, and we should know that from the beginning.

Elinore Longobardi is a Fellow and staff writer of The Audit, the business-press section of Columbia Journalism Review.