Dean Baker bizarrely dismisses the role Wall Street chicanery had in inflating the bubble:

It Was the Housing Bubble: Not the Damn CDOs

But has been made abundantly clear, CDOs were critical part of the housing bubble, especially in 2004-2007. Wall Street created false demand for housing loans by creating these complex securities and convincing rubes that they had no or little risk. That vastly increased money for housing lending. Baker somewhat acknowledges this:

This story has nothing directly to do with CDOs. Insofar as CDOs and other games helped to drive the bubble beyond the levels it would have otherwise attained then they made the crash worse than it otherwise would have been, but the CDOs were not directly the problem. It was the bubble.

But it’s just wrong to downplay securitization’s role in the bubble.

— Speaking of securities inflating the bubble, Felix Salmon talks to my pal Moe Tkacik about Magnetar and is on board with why it’s such a Big Story.

I’m not going to even attempt to get into all the nooks and crannies and conspiracy theories which surround Magnetar, but I think, after talking to Moe at some length, that I have a much better grasp of the very big picture than I did after reading the ProPublica report…

From a systemic perspective, Magnetar had a much bigger effect — and a much worse effect — than Paulson. That’s what makes people like Moe and Yves Smith angry. (Much of what Moe learned she got from Yves and her book.) Magnetar was in many ways the engine which was responsible for many of the worst losses from New York to Dusseldorf. Those losses didn’t directly become Magnetar profits, because Magnetar was long equity and generally hedged in a way that Paulson and Burry weren’t. But they did end up helping to cause the biggest recession in living memory.

I’m going to step up for ProPublica here. Its story very clearly showed how Magnetar nearly singlehandedly kept the bubble going at a critical juncture when everyone else was bailing. Indeed, that’s what I took away from the story, and it was in the lede:

In late 2005, the booming U.S. housing market seemed to be slowing. The Federal Reserve had begun raising interest rates. Subprime mortgage company shares were falling. Investors began to balk at buying complex mortgage securities. The housing bubble, which had propelled a historic growth in home prices, seemed poised to deflate. And if it had, the great financial crisis of 2008, which produced the Great Recession of 2008-09, might have come sooner and been less severe.

At just that moment, a few savvy financial engineers at a suburban Chicago hedge fund helped revive the Wall Street money machine, spawning billions of dollars of securities ultimately backed by home mortgages.

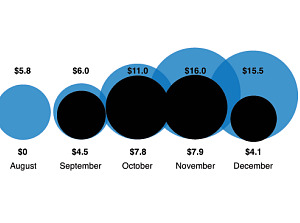

And it had this graphic (click for the full thing):

— If the press hasn’t figured out yet that the rise of cloud computing raises serious privacy issues, Facebook is doing its best to show why. Valleywag’s Ryan Tate, who’s done an excellent job following this issue, reports on a new move by Facebook to unilaterally strip its users of their privacy.

CEO Mark Zuckerberg just announced at Facebook’s annual “F8” developer conference that it’s allowing the outside websites with which it shares user data to hold on to said data. Previously, the partners were supposed to dispose of the information within 24 hours…

Earlier this month, in fact, Facebook took away the option to hide profile data like interests, “likes,” work, education, current city and hometown. The Electronic Frontier Foundation raised a red flag about the change, writing, “The new connections features benefit Facebook and its business partners, with little benefit to you. But what are you going to do about it? “

These guys, and Google, and Apple, for that matter, need way, way more scrutiny than they’re getting. The problem with Facebook: I’d like to quit my account in protest, but the network effects make it difficult to do so. I have some 400 friends and “friends” on there. Years of photos and comments and no way to export them. It’s one of the key ways I stay in touch with people.

In other words, Facebook has us over a barrel. And it’s not hesitating to take advantage of that. Can somebody create a non-evil Facebook? Can the press hammer these guys instead of writing yet another fawning profile of them?

Ryan Chittum is a former Wall Street Journal reporter, and deputy editor of The Audit, CJR’s business section. If you see notable business journalism, give him a heads-up at rc2538@columbia.edu. Follow him on Twitter at @ryanchittum.