A year and a half ago, Quartz wrote that “The New York Times paywall has hit a growth wall.” Since then, it’s grown 23 percent.

Now, Re/code writes that “New York Times’s Digital Subscription Growth Story May Be Ending.” It’s true that the Times‘ paywall growth is slowing considerably after three and a half excellent years, but it’s not ending just yet.

Re/code’s Edmund Lee reports that a McKinsey study the NYT commissioned before the paywall launch predicted that, in the most optimistic scenario, the Times would top out between 800,000 and 900,000 digital subscribers.

The problem is, the Times already hit the low end of that projection in June with 831,000 paying online readers. And the number of new customers it added in the three months leading up to that point, about 32,000, were mostly for the new NYT Now app, a slimmed-down version of the Times that costs $8 a month. It looks like the McKinsey study got it right.

A four-year-old McKinsey prediction, though, isn’t reason enough to think that the Times will plateau at 900,000 or below. For one, its market is huge and worldwide.

For another, the paywall is still growing at a healthy clip. While its new paywall offerings, NYT Now, NYT Opinion, and NYT Premiere, flopped in the second quarter, the Times‘ digital subs were still up 4 percent from the first quarter, while paywall revenue was up 3.5 percent. On a year-over-year basis, digital subs were up 19 percent in the second quarter and paywall revenue was up 13.5 percent. That’s hardly hitting a wall.

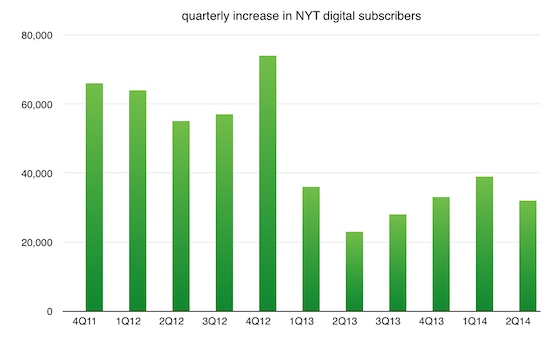

Plus, there’s some reason to think there’s seasonality to paywall growth, though it’s too early to tell for sure. The second quarter was the worst quarter of the year in 2012 and 2013:

And the Financial Times is showing that it’s possible to turbocharge subscription growth even with a mature paywall.

At its current pace, the Times is still adding about $20 million a year in digital subscription revenue. It will approach $170 million for all of 2014, and will hit $200 million by 2016, if it can muster 8.5 percent annual growth, which is hardly unrealistic (particularly if it would go ahead and raise prices a quarter a week).

Online revenue alone would not sustain the New York Times as it exists today. If the Times were to become a digital-only newsroom, it’d be a $312 million business, including the $162.9 million in online ads it generated last year. But that’s only 20 percent of its current sales. In other words, a digital-only Times could just support a fifth of its current newsroom, or around 200 journalists.

Lee is right that the Times can’t abandon print yet. But he’s wrong that its digital revenue could only support a newsroom of 200. It costs a lot less to put out a website than it does to print and distribute a print paper to hundreds of thousands of people in dozens of cities. The Times spends several hundred million dollars a year—at least a third of its operating expenses—doing so.

And a digital-only Times would have more than $312 million in revenue. This year it will bring in more than $330 million in digital ads and subscriptions. But it will also have about $90 million from conferences, its news service, and rights fees. Most of that would presumably survive the demise of a print NYT, giving the paper more than $400 million in revenue. That wouldn’t support the Times‘ newsroom at its (roughly $200 million) current size, but it would likely support one two-thirds as large.

There’s no reason the Times shouldn’t be able to get at least 5 percent annual growth out of its paywall going forward, through a combination of subscriber growth and price increases. But there’s no way for the NYT to make its numbers work in the medium-to-long-term unless it can post consistent digital ad growth. Digital ads have finally begun to turn around this year, but it needs much faster growth. Easier said than done.

Ryan Chittum is a former Wall Street Journal reporter, and deputy editor of The Audit, CJR’s business section. If you see notable business journalism, give him a heads-up at rc2538@columbia.edu. Follow him on Twitter at @ryanchittum.