Sign up for the daily CJR newsletter.

Despite publishers’ disillusionment with low financial returns, there is no sign of them retreating from publishing material directly onto Facebook, Snapchat, Instagram and other distribution platforms.

Anxiety and uncertainty abound around the future of journalism. The initial promises from social media platforms of revenue for publishers are yet to materialize. Even as traffic rises, monetization remains a work in progress. Some publishers and industry watchers have started to question the conventional wisdom pushing the pursuit of scale.

In looking more closely at the relationship between platforms and publishers, it’s impossible to escape the conclusion that platforms are the dominant partner. Mark Zuckerberg’s manifesto last week reminded us that social platforms like Facebook need the words produced by newsrooms to feed its billions of users and generate digital advertising revenue. Publishers rely on social media to exponentially increase the visibility of their work, and to bring in ad dollars via revenue-sharing models that are, slowly, being established.

Research conducted by the Tow Center for Digital Journalism shows publishers wading deeper into the Wild West of social media. During election week alone, the 14 publishers we studied made a total of 12,120 posts designed to sit natively on platforms, rather than drive traffic back to their own websites—an average of 866 per publisher.

We began tracking publishers’ activity on social platforms nine months ago as part of our ongoing Platforms and Publishers project. Our first week-long study in April 2016 covered nine publishers across 12 social platforms: The New York Times, The Wall Street Journal, The Huffington Post, CNN, The Washington Post, Fox News, Vox, Vice News, and BuzzFeed . We have repeated this data collection quarterly, and expanded the research to include four additional platforms and five more publishers, including three regional publishers: the Los Angeles Times, Chicago Tribune, New York Daily News, Buzzfeed News, and Vice.

In April 2016, here’s how nine diverse journalism companies were posting across 21 different platforms:

By February 2017, here’s how this landscape shifted:

There is no singular trend in the data we collected. Publishers are still experimenting with how best to reach, retain, and monetize their audiences. Meanwhile, the platform landscape is constantly changing: The tech companies behind the social platforms are continually competing to outdo (or replicate) their rivals’ latest innovations as they wage their own battles to keep publishers not just on but in their platforms.

Below are 10 takeaways from the three phases of data collection on platforms and publishers:

1. Election week saw a big increase in platform activity

Our third period of data collection began on Monday, November 7, and coincided with the week of the US election. It came as no surprise that we saw significant spikes in publishers’ activity across platforms, compared to the two previous phases of our analysis.

2. Publishers aren’t cooling on Instant Articles

But they’re not going all in, either.

Instant Articles is a format developed by Facebook that allows publishers to post articles natively to the platform. When a publisher posts one of its articles as an Instant Article on Facebook, the mobile reader is directed to a fast-loading page stored on Facebook’s own servers. The downside for publishers is the article does not generate traffic back to the publisher’s own site, resulting in a loss of control over audience data, fewer opportunities to entice users to engage with further content, an increased reliance on Facebook’s ecosystem, and the inability to shield content behind a paywall.

Looking at how much publishers have embraced Instant Articles is a barometer for their attitude toward hosting content on Facebook. Posting an Instant Article represents a clear choice by the publisher: to cede control over advertising and appearance to Facebook.

In September, Digiday reported that some publishers appeared to be “cooling” on Instant Articles. Findings from the first six months of our study do not support this. The picture is rather more nuanced. While some have reined in their use of Instant Articles (CNN), others have increased it (The Huffington Post). While some have remained pretty consistent, others have fluctuated (The New York Times). Our snapshots can’t speak for the publishers’ overall strategy, which may change week to week. But it is clear that there is no mass rejection of Facebook’s native publishing format.

The major players:

- Vox (96%), BuzzFeed News (93%), BuzzFeed (84%), Fox News (83%), The Washington Post (82%), and The Huffington Post (both 82%) have fully embraced Instant. (The Washington Post is no surprise; it decided to go all in on Instant Articles as early as September 2015.)

- The New York Daily News (4%) and The Wall Street Journal (3%) post a tiny proportion of their links as Instant Articles.

- Chicago Tribune, Los Angeles Times, and Vice News are not using Instant articles.

- The New York Times (49%) and CNN (28%) are striking a middle ground.

3. On Instant, Vice News stands out from other digital natives

One might expect digital native Vice News—one arm of a company whose “name has become code for all things millennial”—to post content natively on Facebook like other digital natives such as Vox and BuzzFeed News. But Vice News has outright rejected Instant Articles, posting exactly zero of its articles via Instant. This positions Vice’s strategy alongside the Chicago Tribune and Los Angeles Times—the latter being both tronc-owned, subscription-based regional newspapers.

This strategy aligns with how Vice CEO Shane Smith spoke publicly last year about publishers handing social platforms too much control over the distribution and monetization of journalism:

This is the biggest problem of the world: Facebook has bought two-thirds of the new media companies out there without spending a dime because they own a majority of their mobile. That’s great for Facebook, but bad for their platform. That’s why we’re trying to get on all platforms because we can monetize on all platforms then we can get away from the patrimony of Facebook.

4. Digital natives are embracing native Facebook content…while regional publishers consistently shun it

Of course, the content publishers post on social media goes beyond articles. It can include images, video, and livestreams as well. We make the distinction between “native” and “networked” content in our research. Native content is hosted on the social platform; on Facebook, native content includes Instant Articles, Live video, photos and galleries, non-live videos. Networked content drives traffic to destinations outside of the platforms, such as a publisher’s website: Users follow links that go outside Facebook and on to the open Web.

Below is a chart that shows the proportion of native and networked content publishers posted on Facebook in the week surrounding the election:

Here again, we can see a reluctance of the regional publishers in our sample to cede control of their content to Facebook. There are three possible explanations for this finding.

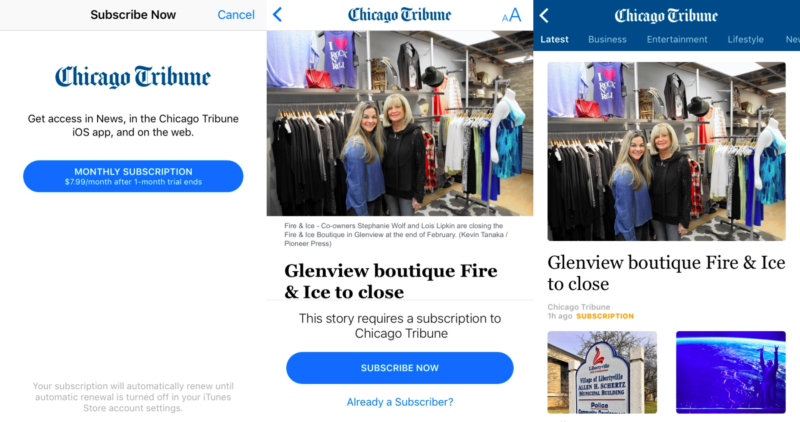

First, the Chicago Tribune and Los Angeles Times have subscription-based business models, which rely on driving traffic back to their websites in order to encourage readers to sign up for access to their paywalled content. Because Instant Articles keep users on the Facebook platform, it could be smart business strategy for these regional papers to only loosely tie their content to the social platform.

On the other hand, there could be cultural reasons why regional publishers such as the Tribune and the LA Times do not post much to Instant Articles. Local and regional newsrooms, often strapped for resources and saddled with a legacy print product, can find it difficult to adapt to the continually changing opportunities and demands of distributed media platforms. As a journalist at one local outlet told us:

We are still very much tied to our print deadlines; people still very much have print job description….I would love to be in a place where we are thinking about engaging an audience via Snapchat Story or Facebook Instant Articles. But…we are just not there yet.

There is one final reason we might expect to see these regional newspapers posting less native content. This pattern may be symptomatic of a broader problem many local publishers have had with gaining access to, and building relationships with, platform representatives. Representatives of local and regional publications have frequently complained in interviews of having less access to, or access to lower-ranking, partnership managers at platform companies. Indeed, neglecting the needs of local publishers in particular is a problem that Facebook has acknowledged publicly.

5. Instagram’s stock is rising among publishers

With an active monthly user base of 600 million and growing, Instagram remains popular with publishers, despite making it close to impossible to drive traffic out of the platform. In keeping with reports of increased engagement by users with publisher content on Instagram, publishers’ use increased sharply during election week. Four-hundred-and-eight Instagram posts were recorded (340 images and 68 videos)—almost twice as many posts made during the first two rounds of data collection. This may in part be driven by Instagram’s introduction of an algorithm that changed users’ feeds from being chronological to being “ordered to show the moments we believe you will care about the most,” a move said to have created “a direct mandate [for publishers] to post photos, videos and stories that users want.”

A number of publishers upped their Instagram game during election week, most notably Fox News and CNN. Fox News made 105 posts over the week (an average of 15 per day), smashing its previous record of 52. CNN posted 50 times—almost three times the 17 made in both previous data collection periods.

6. Snapchat Stories and Instagram Stories facilitate TV-like coverage, raising questions about brand/image

Platforms such as Snapchat Stories and Instagram Stories encourage publishers to build content through a rapid series of punchy, sequential visual updates. As such, they are often used to provide live, insider coverage of pre-arranged events or dramatic breaking news stories.

The Washington Post makes extensive use of Snapchat Stories to cover events. In our April collection, 73 of the 84 snaps were dedicated to live coverage of the White House Correspondents’ Dinner. In the November collection, their Snapchat included election coverage, anti-Trump riots, and the Cleveland Cavaliers’ visit to the White House.

Above: Snaps from The Washington Post for the White House correspondents’ dinner.

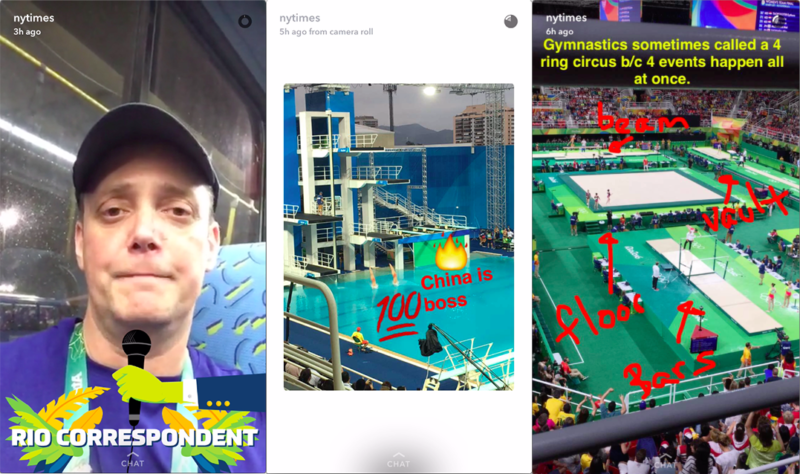

In our August collection, The New York Times amassed 216 snaps (easily the most we’ve observed from any one outlet since our study began), thanks to daily updates and reports from the Rio Olympics. The sheer quantity of snaps from the Times indicates a strategic decision to provide daily Olympics coverage via Snapchat Stories. But the visual style is also noteworthy. Much of the coverage contained garish bright text, arrows scrawled by finger, giant emojis, and uncharacteristically colloquial phrases like “China is boss,” in a break from what one might typically associate with The Gray Lady. Most of the snaps began and ended with a journalist talking directly to the camera, like a TV newscaster.

Content such as this prompts a number of questions around publishers, platforms, and brand. Is the Times adapting its style in an attempt to appeal to Snapchat’s core demographic? Or is it using the likes of Snapchat Stories and Instagram Stories to take risks and experiment, since any missteps will disappear within 24 hours? How does a newsroom’s native brand translate from one platform to another?

Above: Snaps from The New York Times during the Rio Olympics.

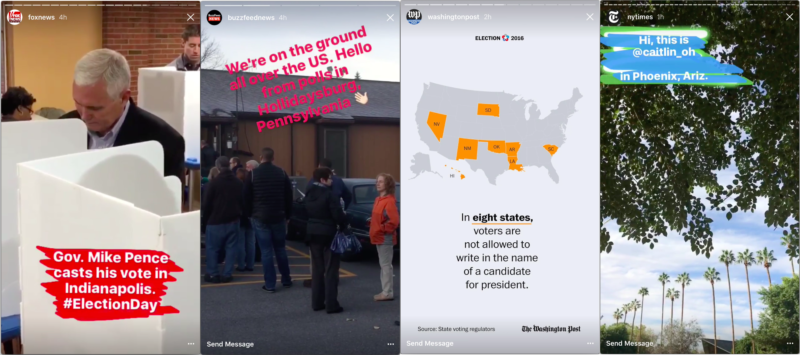

7. Instagram Stories are pretty new, but many publishers have been quick to adopt it

Instagram Stories was only one week old when we collected data in August 2016, but many publishers were already showing a willingness to use it. During the week of our analysis, we recorded 151 stories across five accounts. (CNN in particular used it extensively in coverage of the Rio Olympics.) Three months later, during Phase 3, that figure jumped to 253 stories from eight accounts.

The platforms active on Instagram Stores also strongly correspond to those on Snapchat, indicating a strong commitment to visual, ephemeral content across both platforms. The Washington Post, Fox News, and The New York Times—the three most active on Instagram Stories during election week—also accounted for 76 percent of the snaps we saw during that time.

Finally, while the overall number of snaps recorded on Snapchat Stories (319) was greater than the equivalent for Instagram Stories, it was the lowest figure for Snapchat we’ve seen so far—bucking a general trend for higher levels of use during the week of the election.

Above: Instagram Stories from select publishers during election week.

8. For video, most publishers go with Facebook over YouTube

YouTube’s potential audience and opportunities to monetize carry obvious appeal for longer-form video. The format has become a priority for Facebook, with strategic changes to the News Feed algorithm favoring video.

A direct comparison between Facebook and YouTube shows that the majority of the publishers in our study posted more videos to Facebook (both regular and live) than to YouTube. In fact, the vast majority of videos uploaded to YouTube have come from just three publishers: the two broadcasters, CNN and Fox News, and The Wall Street Journal. Even CNN, among the most prolific YouTube users, recorded very similar numbers across the two platforms, posting 247 videos to Facebook (56 Live and 191 regular)—only nine fewer than it uploaded to YouTube.

9. iOS 10 persuaded some subscription-based publishers to embrace Apple News

Above: Paywalled content on the Chicago Tribune’s Apple News channel.

In September 2016, Apple released iOS 10, which gave publishers the option of placing Apple News articles behind a paywall. When users first attempt to access such content, they are greeted by a message stating that the story requires a subscription and prompted to either enter their existing credentials or sign up for an in-app subscription (with Apple taking 30 percent of subscription revenue). For some subscription-based publishers, this option paved the way for their use of the platform. The number of articles posted by the Chicago Tribune increased 1,810 percent, from 67 (in the August collection) to 1,280 during election week. The Wall Street Journal’s output increased tenfold, from 40 to 433, while The Los Angeles Times’ went up 68 percent, from 513 to 864. The paywall was not adopted by all of the publishers with a subscription model—most notably, The New York Times, which continues to offer free content via Apple News.

10. LinkedIn, Pinterest, and Tumblr are important to certain publishers

Facebook, Instagram, Snapchat, Apple, and Google inevitably dominate the conversation around platforms and publishers. But others—such as LinkedIn, Pinterest, and Tumblr—remain an active part of many strategies. Both The New York Times and The Washington Post made a significant number of posts to all three, Vox is a frequent user of LinkedIn and Tumblr, while The Wall Street Journal makes consistent use of LinkedIn.

The Platforms and Publishers project at the Tow Center for Digital Journalism is supported by the John D. and Catherine T. MacArthur Foundation; John S. and James L. Knight Foundation; The Foundation to Promote Open Society; The Abrams Foundation, Inc.

Has America ever needed a media defender more than now? Help us by joining CJR today.