Sign up for the daily CJR newsletter.

Gannett’s fourth-quarter newspaper results, announced Tuesday, were basically miserable.

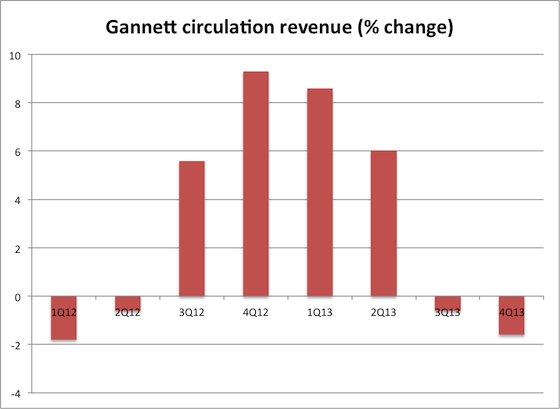

Revenue at its publishing segment dropped 4.6 percent in the fourth quarter from last year (excluding 2012’s extra week), with advertising dropping 5.9 percent and circulation falling 1.6 percent. The last figure is key.

As Rick Edmonds writes, “Gannett earnings report hints at a coming problem with paywalls.” Indeed it does, though it’s not an unforeseen problem.

The issue is one that will particularly affect newspapers like Gannett’s that have leaned on large print price increases as part of their paywall strategies. For lower-quality publishers like Gannett, which has squeezed profits out of its newspapers for decades, the paywall money has been in print, not digital.

Gannett was particularly aggressive with its print price increases. Problem is, you can only jack up prices 25 percent so many times.

The medium- to long-term point of a paywall strategy is to create a new, growing digital revenue stream while protecting your existing digital-ad business and slowing the decline of print revenue as much as possible. The end game is, hopefully, an all-digital business that can support a strong newsgathering operation without print subsidies.

But a paywall imposes the quality imperative more than ever. You have to have a strong newsgathering operation to justify charging online in the first place.

Gannett, though, has a well-earned and long-established reputation for high margins and poor quality. Last year it generated 22 percent operating cashflow margins, paid out $183 million in dividends, and laid off hundreds of journalists.

It’s worth pointing out that Gannett doesn’t break out its digital-only subscriber numbers in its securities filing. A year ago it had snared a pitiful 46,000 subscribers across its 81 papers but projected it would have a quarter-million digital-only subs by now. You can bet it didn’t come close to that. If Gannett had something remotely positive to say, it would tell us.

Contrast that with the Minneapolis Star Tribune, which remains a quality paper and which has had early success with its digital-subscription strategy. Publisher Michael Klingensmith tells me the Strib‘s $3-a-week ($156 a year) paywall has brought in 30,000 digital subscribers. The paper incentivizes digital subscribers to take the Sunday paper by cutting $2 a week off the paywall price, and some 14,000 of them do so.

The Strib‘s digital subs are up from 20,000 a year and a half ago when the meter cost $2 a week. That’s a 33 percent annualized growth rate, though that will slow sharply.

“The institution of the pay meter coupled with all-digital access subscriptions is the most important and beneficial strategic decision we’ve made in the last four years,” Klingensmith says.

The Star Tribune‘s circulation revenue rose 7 percent last year, even though it began

its paywall plan at about the same time Gannett did. We don’t need to mention The New York Times.

So has the paywall pig made its way through the python for Gannett’s papers and for weak papers like them?

Mostly, with the caveat that revenues are still significantly higher than they would otherwise be.

Gannett’s quarterly circulation decline is the company’s first second consecutive since it began its All Access Content Subscription Model (aka paywall) in earnest seven quarters ago. It took in $288.4 million in circulation last quarter, up from $268.1 million in the fourth quarter of 2011. Taking into account Gannett circulation’s pre-paywall downward trajectory, the company took in roughly $31 million more in the quarter than it would have without the All Access strategy (it’s important to note that digital circulation revenue almost surely was still solidly positive in the fourth quarter, but was overcome by print circulation declines. Gannett didn’t break those numbers out.)

The critical thing here, though, is that Gannett’s circulation revenue and operating profit would be much lower without its paywalls—something on the order of $100 million, according to executives. In the meantime, with its meter model it has continued to grow its papers’ digital revenue, which was up 11 percent in the fourth quarter, despite cycling through last year’s fourth quarter gains, which were 87 percent.

Gannett says it hopes to boost circulation revenue this year again with its USA Today inserts, but that will be from print price increases not digital-circulation gains.

Bottom line: If you’re going to charge people for journalism, you have to invest in journalism.

Has America ever needed a media defender more than now? Help us by joining CJR today.