Sign up for the daily CJR newsletter.

The Journal today goes a good way toward catching up with the Times on the New York pension-fund kickback scandal with a report that Steven Rattner met with one of the key players in the scheme, paid “finders fees,” and invested in a two-bit movie with the guy’s brother.

This looks very bad for Rattner, who’s now a senior administration official in charge of the auto-industry recovery.

First a bit of background on the scandal:

In the long-running pay-to-play case, authorities allege that about 20 investment firms made payments in exchange for investments from the $122 billion New York State Common Retirement Fund. The case, being investigated by New York Attorney General Andrew Cuomo and the SEC, has led to three criminal indictments and a guilty plea. The attorney general’s office and the SEC declined to comment.

The Times has been on top of this story, and this from its story a couple of days ago better explains what the scandal entails:

…two aides to the former state comptroller, Alan G. Hevesi, who were accused of selling access to the state’s $122 billion pension fund and reaping millions of dollars for themselves.

The Times reported a few days ago that Cuomo is investigating the firms who paid the “placement fees”—including the Carlyle Group, one of the most prominent and powerful private-equity firms in the world.

The Journal scoop exposes Rattner (a New York Times reporter, of all things, in a past life) as the unnamed executive is in an SEC complaint on the pension scandal. This raises questions about the Obama administration’s judgment since a spokesman says Rattner told them about the investigation when it vetted him for his current position.

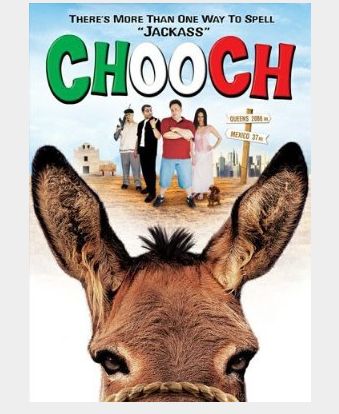

You may remember the move Chooch that figured in the NYT story the other day (I’m still waiting for readers’ reviews. Anyone? Bueller? Somebody send me something or I may be forced to review it in detail for The Audit).

This instant classic of the silver screen (or, excuse me, the straight-to-Netflix genre) plays prominently in the Journal‘s really good stuff:

The SEC alleges in its complaint that a meeting was arranged between the senior Quadrangle executive and a brother of New York’s then-deputy comptroller to discuss acquiring the DVD distribution rights to the low-budget film, “Chooch.” The deputy comptroller, now under indictment, and his brothers produced the movie.

Quadrangle, through an affiliate called GT Brands, agreed to acquire the rights for $88,841, and three weeks later the deputy comptroller told the senior Quadrangle executive that Quadrangle would get a $100 million investment from the pension fund, according to the complaint. Quadrangle then paid the $1.1 million finders fees to a company affiliated with the political consultant, according to the complaint.

Now why in the name of 20 percent levered returns would a highfalutin firm like Quadrangle buy a dog of a movie like this, one titled Chooch? One that just happened to be produced by the deputy comptroller with his brothers?

I don’t think so.

Look for Rattner’s exit from the Obama administration in the next few weeks, with the usual excuse that he doesn’t want to be a “distraction” for the president.

Good reporting by the WSJ.

Has America ever needed a media defender more than now? Help us by joining CJR today.