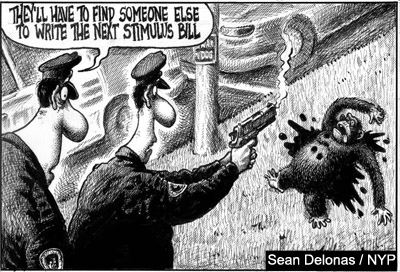

Sinner: Sean Delonas. The New York Post contributor drew a cartoon yesterday depicting two policemen shooting a chimpanzee, with this caption: “They’ll have to find someone else to write the next stimulus bill.” Delonas’s work accomplished something which FCP would not have imagined possible: It set a whole new standard for tastelessness and stupidity for his newspaper.

Winners: Hendrik Hertzberg and Frank Rich for offering their usual correctives to idiotic Washington reporting, this time by explaining why the passage of Obama’s stimulus program was an extraordinary victory for the new president, despite all the blather on cable TV about the President’s failure to attract any Republican support in the House. Hertzberg pointed out that, unlike every Republican in the House, four Republican governors joined fifteen Democrats to endorse the stimulus package. The New Yorker writer noted, “A Republican governor, you might say, is sort of like a Republican congressman—except with actual responsibilities.”

In the Times, Frank Rich provided the relevant historical perspective:

Republicans will also be judged by the voters. If they want to obstruct and filibuster while the economy is in free fall, the president should call their bluff and let them go at it. In the first four years after F.D.R. took over from Hoover, the already decimated ranks of Republicans in Congress fell from 36 to 16 in the Senate and from 117 to 88 in the House. The G.O.P. is so insistent that the New Deal was a mirage it may well have convinced itself that its own sorry record back then didn’t happen either.

Winner: Bill Moyers, for another great interview about the financial meltdown, this time with Simon Johnson, a former chief economist at the International Monetary Fund. Johnson now teaches global economics and management at MIT’s Sloan School of Management, and is a senior fellow of the Peterson Institute. Here are a few of his thoughts about bankers and their banks:

There’s a small group of people who got you into a disaster, and who were still powerful. Disaster even made them more powerful. And you know you need to come in and break that power. And you can’t. You’re stuck…the policy that we seem to be perusing, of being nice to the banks, is a mistake. The powerful people are the insiders. They’re the CEOs of these banks. They’re the people who run these banks. They’re the people who pay themselves the massive bonuses at the end of the last year.

Johnson’s main proposal: The government should temporarily take over the big banks and throw our their current managers:

We have no problem in this country shutting down small banks. In fact, the FDIC is world class at shutting down and managing the handover of deposits, for example, from small banks. They managed IndyMac, the closure of IndyMac, beautifully. People didn’t lose touch with their money for even a moment. But they can’t do it to big banks, because they don’t have the political power. Nobody has the political will to do it.

So you need to take an FDIC-type process. You scale it up. You say, “You haven’t raised the capital privately. The government is taking over your bank. You guys are out of business. Your bonuses are wiped out. Your golden parachutes are gone.” Okay? Because the bank has failed.

Winner: Michael Kirk, for the first hour of his three-part documentary, Inside the Meltdown. Highlights included Joe Nocera of The New York Times describing ex-Treasury Secretary Paulson’s attitude toward Lehman Brothers CEO Dick Fuld—“he was way, way angry at him”—and Paul Krugman on the impact of Paulson’s decision to let Lehman fail:

Charles Kaiser is a former media critic for Newsweek and the author of three books, most recently The Cost of Courage, about one family in the French Resistance.By Wednesday, you’d basically had a complete shutdown of the world capital market. No, this is actually terror. I’m sure that Paulson is sitting there, doesn’t strike me as the most reflective guy necessarily, but he must have been sitting there — everybody was sitting there saying, ‘My God, we may be presiding over the second Great Depression.’ This is the utter nightmare of an economic policy-maker. You’re sitting there, and you may have just made the decision that destroyed the world.