A big part of the problem with Mitt Romney’s “47 percent” characterization, as I wrote yesterday, is that it uses federal income tax to snooker people not paying close attention into thinking half the country pays no taxes at all.

That’s cherry picking the most progressive part of the tax system to paint a picture of half a country of indolent moochers.

Almost everyone pays state and local taxes, sales taxes, excise taxes, and payroll taxes, and those are far more regressive than federal income taxes. Here in Washington state, for instance, the top 1 percent of earners pays 2.6 percent of their income in state taxes while the poorest 20 percent pay 17.3 percent. While Washington is the most regressive state, not one state has progressive taxation (only D.C. does, barely).

The Atlantic‘s Matthew O’Brien pulls a chart from the liberal Citizens for Tax Justice that shows how this plays out when you look at all government taxes:

It’s not exactly a picture of moochers waging war on heroic entrepreneurs.

We barely have a progressive tax system.

— Roosevelt Institute’s Mark Schmitt writes about the American Enterprise Institute’s role in creating the “makers” vs. “takers” meme:

A look at the individual programs behind all of these charts indicates that the big story is the extension of the social safety net from the very, very poor to the lower rungs of the working poor, particularly through expansion of Medicaid and tax credits for working families. With bipartisan support, these innovations have fundamentally changed the social safety net that both conservatives like Charles Murray and Lawrence Mead and liberals like David Ellwood described in different ways two decades ago: a system in which it really did make more sense for poor parents not to work than to give up the linked package of benefits that went with non-work, including welfare, Medicaid, and food stamps. Meager as those benefits were, they were often economically preferable to a minimum-wage job without health care or other assistance, and with the added costs of child care.

Changing that system was not just a matter of imposing work requirements, but of smoothing the path into the workforce and toward self-sufficiency. Medicaid eligibility was delinked from welfare and linked instead to income, starting at 100 percent of the poverty level and reaching 185 percent in the Affordable Care Act. Together with the State Childrens’ Health Insurance Program, expansions of the Earned Income Tax Credit, the Child Tax Credit, the Refundable Additional Child Tax Credit, the Child and Dependent Care Credit, the Make Work Pay Credit, expansion of child care, the after-school and summer food programs, and others, we have created a safety net that extends well into the low-income working population. These individuals, too, are both takers and givers – they are working hard, contributing to the economy, and while some of them may not pay federal income taxes at the moment, they will as they move up.

Schmitt also has an interesting thread on the role of the so-called submerged state in the perception of half a country of moochers versus the reality. Almost everyone benefits from government social programs like student loans or the child tax credit, but most people who get them don’t realize they’re a redistribution via social program.

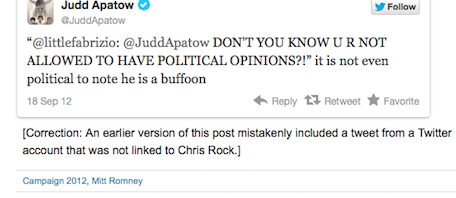

— A shout out to The Wall Street Journal for rounding up “Twitter Tweets About Mitt Romney’s 47 Percent Comments” from Ashley Judd, Russell Simmons, Moby, and a guy who apparently pretended to be Chris Rock.

I’m sure there are SEO reasons for such a Hamster Wheel post, but seriously, could anybody possibly care what Scottish novelist Irvine Welsh has to think about Mitt Romney?

Ryan Chittum is a former Wall Street Journal reporter, and deputy editor of The Audit, CJR’s business section. If you see notable business journalism, give him a heads-up at rc2538@columbia.edu. Follow him on Twitter at @ryanchittum.