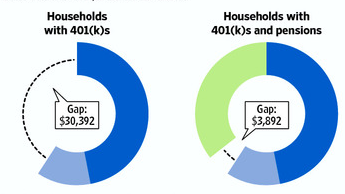

Back in February, The Wall Street Journal‘s Jim Browning looked at how the Boomers are the first generation to retire after the move by companies from defined-benefit pensions to defined-contribution 401(k)s, which looks to be a bust of historic proportions. The average 60 to 62 year old with a 401(k) has less than one-quarter the assets needed to fund retirement, while the near-retired with pensions are doing much better:

In September, he wrote about how the housing bust has left Boomers with five times the mortgage debt their parents had when they hit retirement age in the 1980s.

Today, Browning and the WSJ gives us their third Boomerpocalypse page-one story this year, looking at how the Great Recession has left a huge number of near-retirement-age Boomers unemployed or underemployed, making their retirement crisis that much more acute.

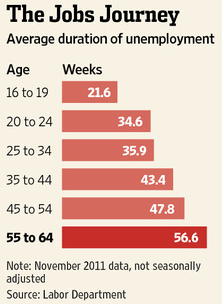

The older Boomer (55-64) unemployment rate is 6.5 percent, but when you count part-time workers who can’t get full-time jobs, as well as people who have given up looking for work and don’t get recorded in headline unemployment statistics, you get a much uglier 17.4 percent. But while significantly fewer older Americans are jobless than the rest of the population, the ones that do lose their jobs have a much harder time getting new ones. Browning notes that more than half of over-55 unemployed have been out of work for more than two years, compared to less than a third for everybody else. When they do find work, the vast majority take a pay cut.

Browning gives the story color by finding several excellent anecdotes. You’d think someone like Deborah Kallick, for instance, would be able to find work. She’s got a Ph.D., was a professor of biomedical research at the University of Minnesota, and worked in private-sector genome research. But here she is:

She has run out of unemployment insurance, used up most of her retirement savings and is indebted to relatives and credit-card companies…

A good job could settle her accounts, she said. Until then, Ms. Kallick relies on generosity, occasional consulting work and the sale of sweaters, purses and other possessions on eBay.

The second anecdote vividly portrays the straits Boomers find themselves—or will find themselves—in when they retire. Here’s a woman who relies on Social Security for most of her income:

“If I don’t buy a lot of groceries, then I am OK,” said Ms. Paladie, who is divorced. “I do a lot of puzzles sitting here and watching TV. And I play with my bird. And that’s about it.”

She rarely goes out, she said, “but I’ve got a clean house.” To save money, she sometimes eats Frosted Flakes for dinner. She shares them with her African Grey parrot, Muffin, who also likes the sweetened cereal.

Ms. Paladie hasn’t been to the doctor for five years, she said. She frets about paying rent after her unemployment benefits run out next year. Her daughter lives nearby but doesn’t have the room for her, Ms. Paladie said.

I also like how the Journal points out that these problems aren’t just a result of recent events. They’ve been building for years, a consequence in large part of chronically stagnating incomes. The financial crisis and deep recession have just made them much, much worse.

Ryan Chittum is a former Wall Street Journal reporter, and deputy editor of The Audit, CJR’s business section. If you see notable business journalism, give him a heads-up at rc2538@columbia.edu. Follow him on Twitter at @ryanchittum.