Sign up for the daily CJR newsletter.

Bloomberg Markets’s Stephanie Baker-Said has a nice cover story

this month about Nassim Taleb, author of “The Black Swan: The Impact

of the Highly Improbable.” His book, which was published almost a year

ago and is still number 24 on the New York Times Hardcover Nonfiction Best

Seller list, is giving Taleb, a former options trader and hedge fund

manager, the opportunity for some victory laps because he seemed to be way ahead of the curve about the current financial crisis.

The Lebanese-born Taleb, a balding man who labels himself

a philosopher of randomness, has an eerie knack for timing things

right. His most recent book, The Black Swan: The Impact of the Highly

Improbable (Random House), came out in May 2007, just months before

the subprime fiasco rocked global markets and led banks to announce at

least $188 billion worth of writedowns. The book’s message offered

something of a preview of the crisis: that we’re all blind to rare

events and routinely fool our-selves into believing we can predict

risks and rewards.

The “Black Swan Theory” is the talk of Wall Street trading rooms and hedge funds. He now

commands more than $60,000 speaking fees and just earned a $4 million

advance for a follow up book.

The media adore people who say the right thing at the right time. But we hold a special place for the rare people who say right thing before the right time.

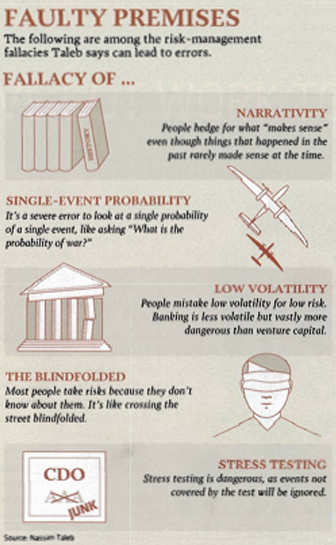

Listen, you can overstate this whole prescience thing. Taleb doesn’t really account for what can be seen as the heart of the problem: lenders pushing idiotic loans on people who couldn’t pay them back and bankers bundling them together with little thought to their quality. He says the problem was that the stress-testing model could not accommodate that scenario. In fact, he thinks most models banks use are bunk. Still, that’s not a bad thought, and a great idea for a story.

Has America ever needed a media defender more than now? Help us by joining CJR today.