Sign up for the daily CJR newsletter.

The New York Times likes to inveigh against executive compensation practices on its editorial pages, and its newsroom has done tough work spotlighting the issue, too. Much of the work is not just about huge dollar amounts but misaligned incentives and pay-for-performance issues.

Jeffrey Goldfarb of Reuters Breakingviews scours its parent company’s proxy and writes that its pay for performance “isn’t fit to print.”

We’ve seen that most obviously in the recent departure of NYT CEO Janet Robinson. She of course, faced the most difficult business environment in the history of newspapers—one that forced other, more-indebted papers into bankruptcy. But, as I wrote in the last issue of CJR, her tenure could hardly be called successful, with a stock down 80 percent, a usurious emergency loan from a Mexican oligarch, and no apparent strategy for a turnaround besides triage and a paywall that should have been in place a decade ago.

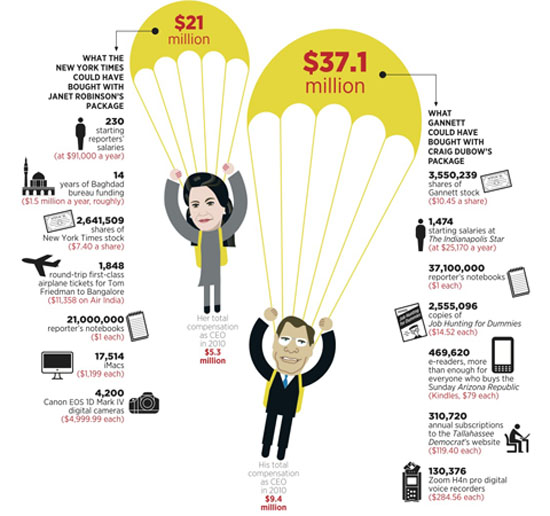

For that she exited with a $24 million package, not any mere $21 million, which was the latest number we had when this graphic went to press:

Bloomberg News noted that the pay package equaled one-fortieth of the company’s market value.

Goldfarb writes that back in 2009, that the company had to see returns on invested capital of 7.3 percent for Times executives like Robinson and Chairman Arthur Sulzberger to get their full bonuses. That proved too difficult to reach in this woeful newspaper environment, so the company lowered the bar. Boy, did they:

The venerable U.S. newspaper group revealed a bonus structure that rewards bosses with 175 percent of their target payouts for achieving a mere 2.5 percent return on invested capital. That’s a fraction of the company’s cost of funds, and much lower than its own previous standard.

The standard to get a 100 percent of the targeted bonus was four times as high just three years ago.

I understand expectations have been lowered in the news business. But it’s interesting to see just how much they’re lowered so executives can get their multimillion-dollar paydays, which have averaged north of $6 million for Robinson and Sulzberger in the last three years.

Remember, whatever the Times used to be, this isn’t even an S&P 500 company anymore.

I thought it might be worthwhile to revisit the Times editorial page’s stance on executive compensation. I found one that’s pretty representative:

What is it with American bankers and their sense of entitlement?

After losing billions, taking billions from taxpayers and avoiding disaster only by selling itself to Bank of America, Merrill Lynch was still ready to give a multimillion-dollar “performance” bonus to its chief executive, John Thain.

The scale is different, sure, but I thought it might be fun to play Mad Libs, New York Times edition.

What is it with American newspaper executives and their sense of entitlement?

After losing millions, taking millions from taxpayers and avoiding disaster only by selling a chunk of itself to Carlos Slim, The New York Times was still ready to give a multimillion-dollar “performance” bonus to its chief executive, Janet Robinson.

As a bonus (no pun intended), recall that a week after handing Robinson a (minimum) $25,000-an-hour consulting contract for a year, the company froze pensions for the proles, making them very angry.

But crickets from the editorial board on this one.

Has America ever needed a media defender more than now? Help us by joining CJR today.