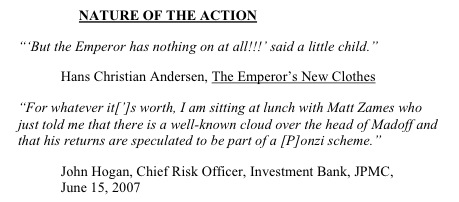

The Picard complaint against JPMorgan, accusing the bank of being “at the very center “of the Madoff fraud, “and thoroughly complicit in it,” is now available in a version which names names. It kicks off in dramatic fashion:

This seems pretty damning, on its face. If JPMorgan suspected Madoff of being a Ponzi, it should certainly not have continued to abet his scheme. But where did Zames get his information? Was it by looking at the flows of cash in and out of Madoff’s accounts? No: Zames is in the investment bank, and was not involved in doing any due diligence on Madoff. Instead, his vivid but nonetheless small role in the complaint is confined to a passing statement he told Hogan over lunch.

Here’s the longer version:

On June 15, 2007, the HFUC [Hedge Fund Underwriting Committee] met to consider the proposal [to create a product linked to Madoff’s funds]. On the very same day, Hogan shared with his colleagues what he had learned from Zames, that it was well-known that Madoff was operating a Ponzi scheme: “For whatever its worth, I am sitting at lunch with Matt Zames who just told me that there is a well-known cloud over the head of Madoff and that his returns are speculated to be part of a [P]onzi scheme-he said if we google the guy we can see the articles for ourselves-Pls do that and let us know what you find.”

Hogan warned, “you will recall that Refco was also regulated by the same crowd [SEC, NYSE, NASD] and there was noise about them for years before it was discovered to be rotten to the core. Hopefully this is not the case here but given Matt’s view, I think we owe it to ourselves to investigate further.”

Nevertheless, Equity Exotics seemed eager to receive approval, and the further research on Madoff was limited to a Google search with no follow-up. Buyers-Russo asked one of her colleagues to “please have one of the juniors look into this rumor about Madoff that Hogan refers to below.” The analyst forwarded an article about a proposed change in SEC regulations that would eliminate a loophole in the regulations governing broker-dealers. He speculated the loophole allowed broker-dealers to run “a ‘[P]onzi’ scheme of sorts.”

Even though the article made no mention of Ponzi schemes and provided no suggestion as to why Madoff in particular would have had a “well-known cloud” over his head, upon information and belief, no further investigation was conducted—even after Zames told Hernandez that he believed his recollection was of a Wall Street Journal article from 2002 and therefore eliminated the possibility that the analyst’s explanation based on a recently-proposed regulatory change was correct.

There are two things missing from this story. The first is that there was no 2002 WSJ article which speculated that Madoff was part of a Ponzi scheme. The bank’s Jennifer Zuccarelli tells me that the article in question was the 2001 Barron’s piece by Erin Arvedlund, which I guess was published on sister site WSJ.com at some point.

The second is that the Barron’s piece itself gave no indication — at least not on its face — that Madoff was a Ponzi. The furthest it went was to raise questions about whether he might be front-running:

Those returns have been so consistent that some on the Street have begun speculating that Madoff’s market-making operation subsidizes and smooths his hedge-fund returns. Why would Madoff Securities do this? Because, in having access to such a huge capital base, it can make much larger bets — with very little risk — than it could otherwise. It works like this: Madoff Securities stands in the middle of a tremendous river of orders, which means that its traders have advance knowledge, if only by a few seconds, of what the big customers in the market are buying and selling. And by hopping on the bandwagon, the market-maker effectively locks in profits.

This is the reason why the Google search that Hogan asked for came up so empty, and probably explains why the analyst was scrabbling around a bit to find anything which suggested that Madoff was a Ponzi. He surely read the Barron’s article, in other words, but he didn’t see in it what Zames saw.

The Barron’s piece seems to have been quite widely read by people interested in Madoff — but mostly the takeaway seems to have been that investing in his funds was a great way of participating in genuine if ethically dubious returns.

Zames, however, read the piece a different way, and came away thinking Ponzi. This probably helps us understand why Zames is now the head of Interest Rate Trading, Global Foreign Exchange, Public Finance, Global Mortgages, Tax-Oriented Investments, and Global Fixed Income at JPMorgan, and touted as a possible successor to Jamie Dimon—while the hapless junior analyst is probably off Wall Street altogether.

Picard clearly goes too far when he says that Hogan “learned from Zames that it was well-known that Madoff was operating a Ponzi scheme.” But it’s surely fair to say that Zames thought “Ponzi” when he heard “Madoff,” as a result of reading the Barron’s article. And since he drew that conclusion, he naturally reckoned that lots of other readers of the article had thought the same thing.

All of which goes to prove that financial sophisticates don’t read the financial press in the same way that the general public does. It’s entirely possible that even Arvedlund herself didn’t suspect Madoff of being a Ponzi. But Zames, perspicaciously, saw that in her piece all the same. Whether that makes JPMorgan complicit in the Madoff fraud is now the subject of some extremely expensive litigation. But there’s a lesson here for financial journalists, which is well worth remembering: bankers don’t confine their reading to the literal meaning of what you write. They infer, and extrapolate, and they assume that everybody else is doing that as well.

Financial journalists, rightly, spend a lot of time trying to be very clear about what they’re saying, in an attempt to be as accessible as possible to people who aren’t financial sophisticates. But in many ways it’s more interesting to wonder what the likes of Matt Zames will think when they read any given piece. What a story says, it turns out, depends a very great deal on who exactly is reading it.

Felix Salmon is a financial writer, editor, and podcaster. A former finance blogger for Reuters and Condé Nast Portfolio, his work can be found at publications including Slate and Wired, as well as his own Substack newsletter.