New York Times Company shares plummeted Thursday as ad revenues were worse than expected, pushing down profits from a year ago.

That’s the bad news. The good news is that the Times’s paywall continues to be a huge success, and a timely one that’s preventing a steep downturn at the company.

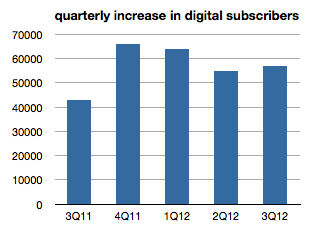

The NYT/International Herald Tribune added 57,000 digital subscribers in the third quarter. That’s an 11 percent jump from the end of June and 75 percent from a year ago—an enormous gain in what is now the sixth full quarter of the paywall. I expected digital subs growth would slow sharply by now, but look at this chart of the number of subs added each quarter since the launch:

The paper now has 566,000 digital subscribers paying roughly $100 million a year between them to read the Times online. I think it’s safe to say that by the end of next year, the Times will have as many paying readers online as it does in print (on weekdays). That would be a landmark shift.

The question, as always though, is whither ads? And the answer wasn’t good as ad declines more than offset circulation qains. The company brought in $16.3 million more from circ (compared to last year), but lost $17.9 million in ads. Meantime its costs rose by $10 million, nearly wiping out its already anemic profit and sending its shares down 22 percent yesterday.

The Times paper lost 11 percent of its print ad revenue, nearly twice as steep as the fall at the company’s New England papers, including The Boston Globe. That print decline may be impossible to stop—though it’s worth noting that the magazine industry has found a way to at least temporarily stop or seriously slow the declines—but the paper has to find a way to reverse the fall of its digital ads.

Those fell 2.2 percent last quarter (for the entire company, which doesn’t break out the Times from the New England papers on this measure) in a newspaper market where others are growing. McClatchy’s were up 5 percent last quarter, for instance.

What’s going on with the digital decline? It doesn’t appear that the paywall is responsible for much of the NYT’s struggles here. More likely, it’s that the paper’s print ads are dragging down its digital ads, a hefty percentage of which are bundled together as upsells. Look at McClatchy: It’s digital ads were up 5 percent, but its digital-only ads were up 17 percent. The Times won’t break out those numbers, but you can bet that its digital-only ads were up, just not enough to offset the decline from upsells.

A critical question is how long circulation can continue to offset ad declines. Importantly, advertising is becoming increasingly less important to the NYT’s financial health. In the latest quarter, ads were 41 percent of its revenue, while circulation was 52 percent. Last year those numbers were 49 percent and 44 percent (much of the decline in ads comes from unloading About.com).

At the Times itself, ads now account for less than 40 percent of revenues, while circulation brings in 55 percent. Advertising is becoming so small and circulation so big that if the last quarter’s trend lines were to continue into next year and beyond, the NYT would actually increase overall revenue each year.

Problem is, the paper almost certainly won’t be able to sustain high single-digit circulation revenue increases for much longer. It’s harder to grow off a bigger base and the price of home delivery is already roughly $800 a year.

The paywall is pulling its weight. Ads are going to have to, as well.

Ryan Chittum is a former Wall Street Journal reporter, and deputy editor of The Audit, CJR’s business section. If you see notable business journalism, give him a heads-up at rc2538@columbia.edu. Follow him on Twitter at @ryanchittum.