The New York Times reports that even in a weak economy, there’s a fairly serious push for increasing the historically low minimum wage, which at the federal level grosses a full-time worker $7.25 an hour or roughly $15,000 a year.

The Times‘s story is fine, but it would have been better if it had had at least one anecdote from somebody earning minimum wage or thereabouts. It’s got lots of elites talking about the merits and pitfalls of a higher minimum wage, but we don’t hear from anybody who actually earns $7.25 an hour.

They’re out there—even in New York City. The most expensive city in the country (and one of the most liberal) doesn’t set a minimum wage higher than what the federal government says you have to pay in Paducah, Kentucky.

WNET Thirteen had a nice piece a couple of months ago where it went around the city and talked to talk to workers making the minimum or just over it.

One of them is a cashier at a Duane Reade a block from The New York Times Building. She makes $7.90 an hour.

Nevertheless the story is a good jumping off point for thinking about the minimum wage.

There aren’t many stats that show how far workers have fallen in this country over the last few decades better than this one: Minimum-wage workers earned about 30 percent more in the 1960s than they do in 2012. The minimum wage peaked at $10.47 in inflation-adjusted terms in 1968, which is still higher than any minimum wage in the country. It’s worth noting that the unemployment rate was much lower back then too.

The Times reports on one push, which seems not to have much political backing, to raise the federal minimum wage to $9.80 an hour. That will surely not happen, particularly since the economy is not going to boom anytime soon and there’s already an excess supply of labor. But even if it did get raised to $9.80 by 2014, the minimum wage would still be about 11 percent lower than in 1968, assuming 5 percent total inflation between now and then.

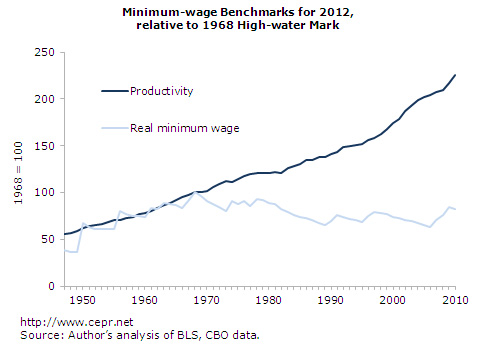

The real-dollar comparisons are crucial for covering this issue, but indexing the minimum wage to inflation doesn’t begin to capture how much low-wage earners have fallen over the past half a century relative to all earners. That’s because overall economy and productivity per worker have grown far faster than inflation. I was talking to Audit Boss Dean Starkman last summer about whether it made sense to gauge minimum wage growth by productivity and GDP growth. I ran some numbers, figured out that a minimum wage indexed to GDP since 1968 would be about $20 an hour today, and… forgot about it.

Luckily, John Schmitt of the liberal Center for Economic and Policy Research was thinking along the same lines and put out a brief recently that shows a minimum wage indexed to productivity growth since 1968 would pay $21.72 an hour today.

CEPR has a very nice chart that shows how the minimum wage tracked productivity growth until right around 1968:

The point of using these measures as an alternative to inflation indexing is to show how a low wage earner’s share of the overall economy has plummeted over the past four and a half decades.

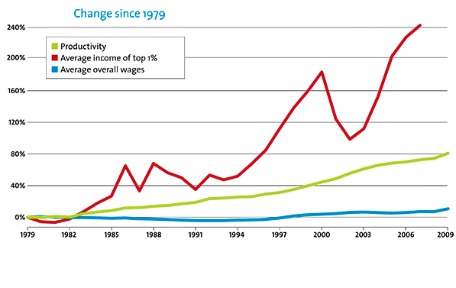

That economic growth had to have gone somewhere, though, and I’m sure you can guess where it went:

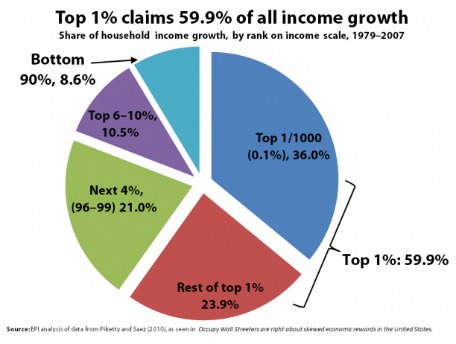

That Mother Jones chart just shows the top 1 percent. But the gains in that lucky group are concentrated amongst the richest of the richest. Most of the gains within the top 1 percent have gone to the top 0.1 percent, which has also captured more than a third of all income gains.

Yes, the top one in one thousand households reaped one in three new dollars earned over the last three decades or so.

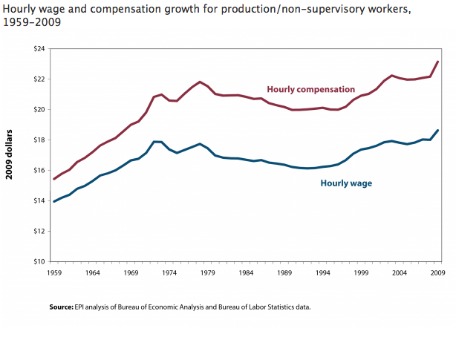

This is no coincidence. Much of the money flooding into the coffers of the top one in one thousand has come from corporate profits, which go higher as workers’ wages go lower. And low wages at the bottom of the heap put downward pressure on wages for people at the 10th and 20th percentiles, say, and on up. Median wages haven’t gone up much either, over the last few decades:

So keep this context in mind if you’re covering this issue. And find an actual worker or two to round out your story.

Ryan Chittum is a former Wall Street Journal reporter, and deputy editor of The Audit, CJR’s business section. If you see notable business journalism, give him a heads-up at rc2538@columbia.edu. Follow him on Twitter at @ryanchittum.