This SmartMoney post on “Why You’re Not Getting a Raise” doesn’t make sense. The lede:

Didn’t get a raise this year? Blame inflation.

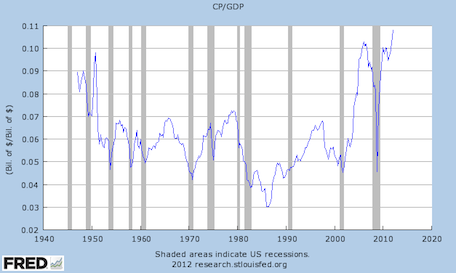

Hmm, I’d blame the weak economy and excess supply of labor before inflation, which seems more correlation than causation. Corporate profits are, after all, at a record high, so the raise money is there:

With unemployment at 8.3 percent and underemployment at 15 percent, there are plenty of people out there who’d love to have your job for less than you take home, as SmartMoney notes.

But let’s roll with Smart Money here on prices. It says wages typically track inflation, and inflation is low, so your raises are low-to-nonexistent. But It also says stuff like this:

While stagnant prices are a boon for consumers on supermarket checkout lines, they can be hard on workers’ bottom lines.

If wages track inflation—and they have over the last few decades as productivity gains have gone almost entirely to capital—it doesn’t matter to workers (in a cashflow sense, as we’ll see below) whether inflation is high or low. If prices rise 10 percent and I get a 10 percent raise, I’m no better off than if prices rise 1 percent and I get a 1 percent raise.

But to the extent that workers tend to be debtors, low inflation and matching wage increases is much worse for them than higher inflation with offsetting wage increases. If you’ve got a $250,000 mortgage on a fixed 30-year note, or $50,000 in student loans, higher inflation is your best friend. It makes it cheaper to pay off your debts. Low inflation makes it more expensive.

Confusingly, SmartMoney’s own data contradicts its premise:

The average base salary increased by 2.7% this year, the same rate as in 2011, according to a survey by human resources consulting firm Mercer.

So you are getting a raise, particularly since inflation was a bit more than half that.

It’s strange that SmartMoney uses this 2.7 percent number from a consulting firm (flack alert!) when we have better data from the government. BLS data on employment costs shows they rose 1.8 percent in the last year, which would actually better fit SmartMoney’s thesis.

If your to-be-sure paragraph has to say something crushingly obvious like this…

To be sure, employees are better off than they would be if prices started rising faster than wages.

… it probably means you’re on the wrong track.

Ryan Chittum is a former Wall Street Journal reporter, and deputy editor of The Audit, CJR’s business section. If you see notable business journalism, give him a heads-up at rc2538@columbia.edu. Follow him on Twitter at @ryanchittum.